Major stock markets across the world experienced their sharpest decline in decades. While there was no paucity of reasons for jittery investor sentiment — for instance, the US economy is facing increasing odds of an economic recession or rising geopolitical tensions due to growing turmoil in West Asia — there was a new global trigger: The unwinding of the yen carry trade.

What Is Yen Carry Trade

Why In News

- Major stock markets across the world experienced their sharpest decline in decades. While there was no paucity of reasons for jittery investor sentiment — for instance, the US economy is facing increasing odds of an economic recession or rising geopolitical tensions due to growing turmoil in West Asia — there was a new global trigger: The unwinding of the yen carry trade.

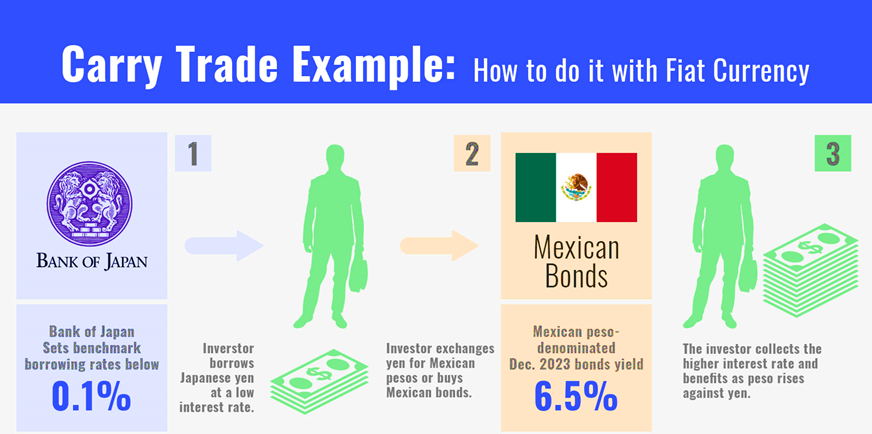

What Is Carry Trade

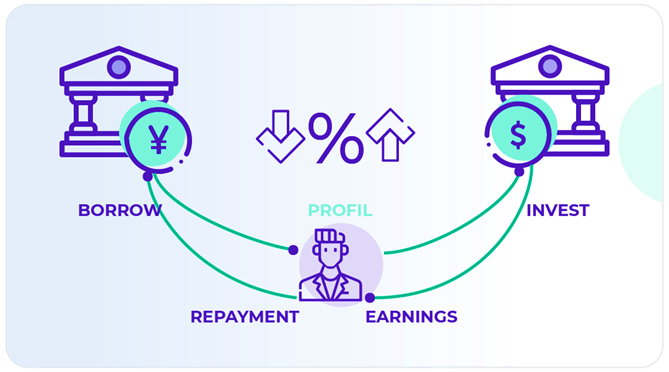

- Global Carry trade is a trading strategy that involves borrowing money at a low-interest cost and investing the same in other assets that provide higher returns.

- Carry trade is popular among forex trades wherein an investor borrows from a country with low interest rates and a weaker currency, and reinvests the money in another country for higher returns.

- Due to the BoJ’s ultra-loose policy for 17 long years, and a weak yen, global investors preferred Japan’s Yen for carry trade.The Japanese Yen has been considered as safe-haven and a favourite among carry-funding options by global investors given the low cost of borrowing.

- According to reports, analysts at Barclays believe that the Japanese currency was the most overbought among G10 majors and therefore “the bar for yet more outperformance in the near term appears high”.

Why Are Investors Now Unwinding The Yen Carry Trade

- Japanese Yen has appreciated by 10 per cent over the last 3 weeks from levels of 161 on July 11 to 145 now. As the Yen appreciated against the US dollar, investors had to rush and unwind their carry trade in order to cut losses. This is said to be one of the reasons for the fall in the US equity market.

- Higher interest rates in Japan led to the yen gaining strength against the dollar and most other emerging economy currencies.

- Over the past week, yen’s exchange rate — that is, how many dollars or rupees does one get for one yen — strengthened against currencies like dollar, real, rupee, peso etc.

- The fear of unwinding of Yen-based carry forward trade, however, has impacted global market sentiment. Markets across Asia were in a deep sea of red, with Japan’s Nikkei tumbling almost 13 per cent on Monday. Kospi and Taiwan slumped over 8 per cent each.