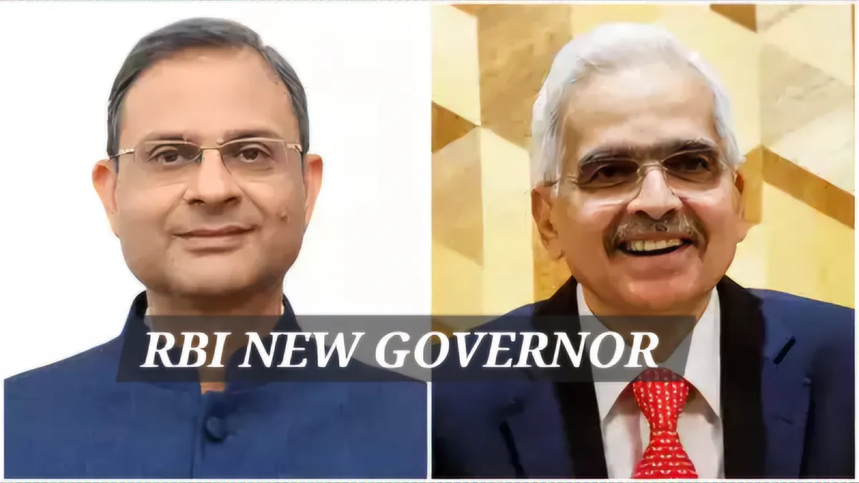

Union government appointed Sanjay Malhotra, the current Revenue Secretary, as the next Governor of the Reserve Bank of India (RBI). Malhotra will take over from Shaktikanta Das, who has led India’s central bank for the past six years, and will serve a three-year term.

Sanjay Malhotra Appointed New RBI Governor

Why In News

- Union government appointed Sanjay Malhotra, the current Revenue Secretary, as the next Governor of the Reserve Bank of India (RBI). Malhotra will take over from Shaktikanta Das, who has led India’s central bank for the past six years, and will serve a three-year term.

How Is RBI Governor Appointed

- Governor of the RBI is appointed by the central government under the provisions of the Reserve Bank of India Act, 1934. The appointment is made by the Appointments Committee of the Cabinet (ACC), which is chaired by the Prime Minister.

- The Department of Financial Services (DFS) in the Ministry of Finance shortlists potential candidates for the role based on their qualifications, experience, and suitability. Recommendations are sought from various experts, bureaucrats, and economists. While the RBI Act does not specify detailed eligibility criteria, the government typically looks for individuals with expertise in economics, banking, finance, or public administration.

Who Is Sanjay Malhotra

- Sanjay Malhotra is a 1990-batch Indian Administrative Service (IAS) officer from the Rajasthan cadre. Over the course of his career, he has worked across various sectors, including power, finance, taxation, information technology, and mining. A graduate in Computer Science Engineering from the Indian Institute of Technology (IIT), Kanpur, Malhotra also holds a Master’s degree in Public Policy from Princeton University.

- Malhotra has previously served as the Chairman and Managing Director of the state-owned Rural Electrification Corporation Limited. Prior to his current role as Revenue Secretary, he was Secretary of the Department of Financial Services in the Ministry of Finance.

- During his tenure in this position, he played a key role in driving financial reforms and strengthening India’s banking sector. Malhotra also served as the ex-officio Secretary to the GST Council, the body responsible for managing the Goods and Services Tax (GST) framework in India. His role required balancing the sometimes conflicting fiscal expectations of states while maintaining the integrity of the national tax system.

- Malhotra was involved in overseeing the government’s non-tax revenue sources, including income from interest on loans, dividends from public sector units (PSUs), and service fees.

- With extensive experience in finance and taxation at both the state and central government levels, Malhotra has been instrumental in shaping policies related to both direct and indirect taxes.

Challenges Ahead

- As the new RBI Governor, Malhotra will face the dual challenge of managing inflation and ensuring stable economic growth. His experience in fiscal policymaking, tax administration, and financial services is expected to shape India’s monetary policies amid global economic uncertainties.

- New governor will take charge of the RBI at a particularly tricky time, when the central bank has to manage the dual imperatives of bringing down inflation to the 4 percent target and boosting economic growth which slumped to 5.4 percent in the second quarter of this financial year.

- The RBI had, under Das, raised the policy repo rate to 6.5 percent in February 2023 and had kept it unchanged 11 times since then, the latest occasion being last Friday’s decision to not lower rates.

Shaktikanta Das

- Shaktikanta Das became the 25th Governor of the RBI on December 12, 2018. It was followed by Urjit Patel’s sudden resignation. He is set to complete his extended tenure on Tuesday. After initially serving a three-year term, Das was granted an extension.

- The career bureaucrat-turned-central banker’s term is ending on December 10. This is the second three-year extension granted to Das and he is already one of the longest-serving RBI governors in its 90-year history.

- His leadership was pivotal in stabilizing the financial markets during a period of uncertainty caused by a dispute between the RBI and the government over surplus transfer issues.

- Since 2014, Raghuram Rajan, Urjit Patel, and Shaktikanta Das have served as Governors of the Reserve Bank of India, with Shaktikanta Das holding the second-longest tenure in RBI history. His tenure is the second-longest tenure after Benegal Rama Rau, who served in the role for over seven years.