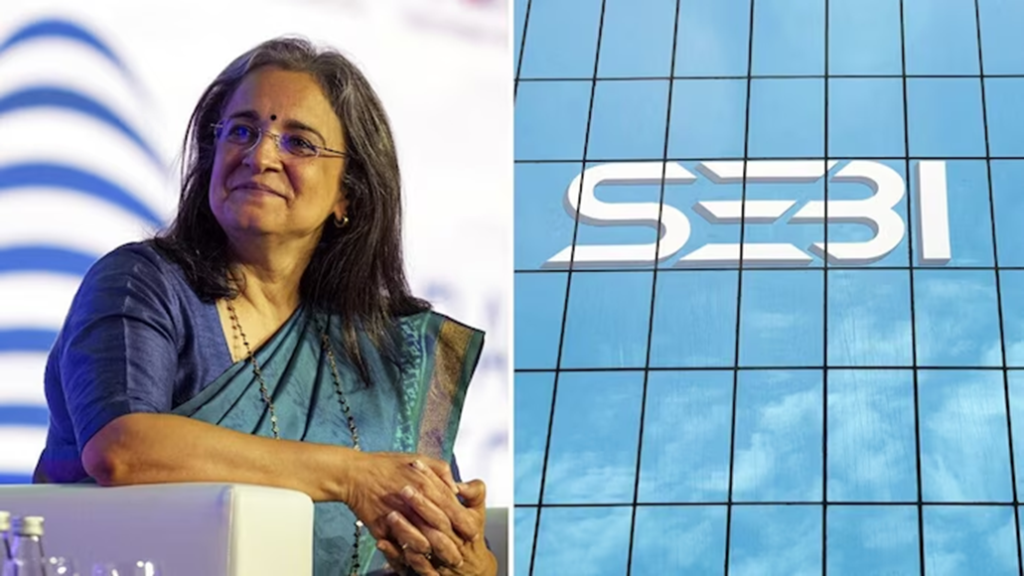

A special anti-corruption court in Mumbai has ordered the registration of a First Information Report (FIR) against top officials of the Securities and Exchange Board of India (Sebi), including former Chairperson Madhabi Puri Buch, whole-time members Ashwani Bhatia, Ananth Narayan G, and Kamlesh Chandra Varshney, as well as Bombay Stock Exchange (BSE) Chairman Pramod Agarwal and CEO Sundararaman Ramamurthy in a case related to alleged stock market fraud and regulatory violations.

Stock Market Scam FIR On ex SEBI Chief Madhabi Puri Buch

Why In News

- A special anti-corruption court in Mumbai has ordered the registration of a First Information Report (FIR) against top officials of the Securities and Exchange Board of India (Sebi), including former Chairperson Madhabi Puri Buch, whole-time members Ashwani Bhatia, Ananth Narayan G, and Kamlesh Chandra Varshney, as well as Bombay Stock Exchange (BSE) Chairman Pramod Agarwal and CEO Sundararaman Ramamurthy in a case related to alleged stock market fraud and regulatory violations.

- A single-judge bench of Justice Shivkumar Dige issued this directive after Solicitor General Tushar Mehta and senior counsel Amit Desai mentioned some petitions for urgent hearing, which were still in the process of being filed on Monday morning. Mehta and Desai, representing various SEBI and BSE members, argued that the Sessions Court’s order was legally unsustainable since the respondents — officials named in the complaints — had not even been issued a notice.

- The order was issued by Special Judge SE Bangar on a petition filed by a RTI-journalist. The complaint accuses Sebi officials of facilitating market manipulation and enabling corporate fraud by allowing the listing of Cals Refineries, which got liquidated in 2019.

What Is The Case?

- The complaint against former chief of Sebi, its three whole time directors and BSE officials in the 1994 Cals Refineries stock listing fraud case was filed by Sapan Shrivastava, 47, a legal reporter from Dombivali in Maharashtra’s Thane district. The complainant seeking an FIR registration, asked for an investigation into alleged large-scale financial fraud, regulatory violations, and corruption.

- The charges relate to the alleged fraudulent listing of Cals Refineries Ltd on the stock exchange in 1994, reportedly with the involvement of regulatory authorities, particularly Sebi, without adhering to the compliance requirements under the Sebi Act, 1992.

- The complainant argued that Sebi officials neglected their statutory duty, facilitated market manipulation, and enabled corporate fraud by permitting the listing of a company that did not meet the prescribed norms.

- In his complaint, Shrivastava alleged that Madhabi in connivance with other authorities of the SEBI and the BSE, allowed “fraudulent” listing of a company on the stock exchange and also did not take any action against the said company for its wrongs.

- According to Shrivastava he and his family had invested in shares of Cals Refineries Ltd on December 13, 1994, which was listed at BSE India, and that he had suffered huge losses. He claimed that SEBI and the officials of BSE did not act against the crimes of the companh and instead listed it against the law, and even failed to protect the interests of investors.

- The complaint alleged manipulation of the market by officials BSE and SEBI, who allegedly facilitated the corporate fraud by allowing the listing of the company.

SEBI Statement

- Soon after the court issued the order, Sebi issued a statement in support of Buch calling the complainant “a frivolous and habitual litigant” and alleged that his previous applications had been dismissed by the court, “with imposition of costs in some cases.”

- The market regulatory body said in the that statement that it would be initiating legal steps to challenge this order and claimed that it “remains committed to ensuring due regulatory compliance in all matters.”

- In August last year, Buch and her husband Dhavan Buch were in the news after an investigation was put out by the shortseller firm Hindenburg Research (now disbanded) claiming they had “undisclosed investments” in offshore entities linked to the Adani Group.

- According to Hindenburg, the Buchs held stakes in Bermuda and Mauritius-based funds allegedly connected to Vinod Adani, the brother of Gautam Adani. Hindenburg also alleged that during her time as Sebi chairperson, Buch owned a Singaporean consulting firm, Agora Partners, which she later transferred to her husband.

- The firm did not publicly report its financials, leading to questions about the transparency of her financial dealings. Both Buch and her husband denied these allegations. No action was initiated against them by the Indian probe agencies.