SpaceX’s Starlink, a network of low-earth orbit broadband satellites, has recently secured a significant license from India’s Department of Telecommunications (DoT), marking a pivotal step in its efforts to deliver high-speed internet services in a country with one of the largest, yet unevenly connected, internet user bases globally.

Starlink operates nearly 7,000 small satellites, with plans to expand to tens of thousands. These satellites provide high-speed, low-latency internet by relaying user data from ground dish terminals to the internet backbone. The newly acquired GMPCS authorization allows Starlink to develop its ground infrastructure and secure the necessary spectrum for broadband service in India. As of now, India has around 954 million internet users, but a considerable disparity exists in rural access; only about 398 million users reside in rural areas, while fixed broadband connections are limited to approximately 41 million compared to 904 million mobile users.

The presence of a satellite internet provider like Starlink could significantly enhance connectivity in regions where fiber optics or cellular towers are not feasible. The need for such services is underscored by millions of users, including farmers and those residing in remote mountainous areas, who depend on unreliable wireless connections.

Globally, Starlink has garnered around 4.6 million subscribers as of 2024, delivering download speeds ranging from 50 to 200 Mbps. The service has proven especially valuable during crises, as seen during the Russian invasion of Ukraine and in the aftermath of natural disasters worldwide. With the licensing approval from the DoT, Starlink becomes the third company, following OneWeb/Eutelsat and Reliance Jio’s satellite venture, to gain such authorization in India. This milestone comes after a thorough evaluation of Starlink’s security commitment and investment structure, indicating the government’s acceptance of the company’s plans for data localization and compliance with local regulations.

Despite advancements, India’s digital landscape remains marked by significant challenges. While the government’s BharatNet initiative has brought fiber connections to around 213,000 village hubs, broadband penetration outside urban areas remains frustratingly low. Many rural households still encounter slow internet speeds or sporadic connectivity, and Starlink aims to address these “last-mile” challenges, particularly in areas that remain offline or poorly served by existing mobile networks.

The potential impact of Starlink’s services extends beyond mere connectivity. Reliable satellite internet could enhance education through online learning and offer telemedicine opportunities in remote health centers, empowering communities lacking bandwidth. It could also stimulate local economies by enhancing access to e-commerce and digital banking, subsequently lifting incomes and creating job opportunities. Government services, including e-governance and emergency response units, could also benefit from the dependable connections that Starlink can provide.

As the market heats up, competitors like Reliance Jio and Bharti Airtel’s OneWeb venture are racing to launch their own satellite services. JioSpaceFiber, for instance, aims to deliver gigabit broadband using medium-earth orbit satellites, while Airtel plans to utilize OneWeb’s network. These incumbents are already demonstrating services in challenging terrains and have partnerships with established satellite entities for enhanced rural connectivity.

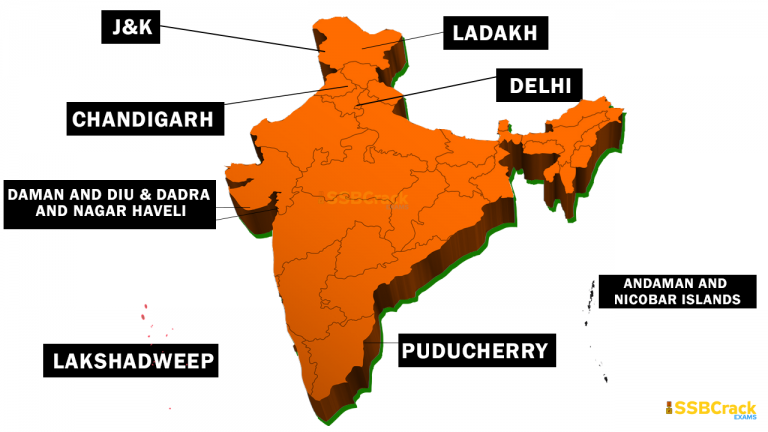

Yet, Starlink faces numerous hurdles before establishing its foothold in the Indian market. The prevailing regulatory environment imposes strict licensing conditions, including geographic restrictions to block signals near international borders and stringent requirements for data localization. Additionally, incumbent telecom operators are voicing concerns about an uneven playing field, fearing that the satellite providers will pay significantly less in licensing fees compared to mobile broadband operators.

The economic landscape also presents challenges; while Starlink’s early pricing strategies may tap into the rural market, the overall cost of its technology remains high. Current user kits, which can cost hundreds of dollars, may struggle to appeal to economically constrained rural consumers unless prices are aggressively competitive.

Geopolitical dynamics further complicate Starlink’s operations. India’s reliance on a U.S.-controlled satellite provider brings concerns about national sovereignty, especially given the sensitive security landscape along India’s borders, where unauthorized satellite devices have caused operational challenges in the past.

The ambiguity stemming from potential shifts in U.S. political strategies towards tech companies like SpaceX adds another layer of uncertainty regarding Starlink’s future in India. Local initiatives to bolster indigenous satellite capabilities might accelerate as a precautionary measure against over-reliance on a foreign entity.

With the license in hand, the next steps for Starlink will involve obtaining final approval from India’s space regulator and conducting spectrum tests before any commercial rollout. Analysts predict that Starlink could introduce its services in India in approximately 6 to 9 months. Drawing comparisons with international pricing models, initial reports suggest potential pricing as low as ₹840 per month, which, if realized, could dramatically undercut existing broadband offerings.

The Indian market is poised for a transformative shift as Starlink prepares to launch. Stakeholders aim to ensure that its introduction serves not merely as an option but as a genuine improvement in connectivity for millions. If Starlink can deliver on its promises, it might revolutionize how India approaches broadband access, making choices between fiber, 5G, and satellite technology a tangible reality for consumers. With the government’s initiative supporting satellite broadband growth, the digital landscape in India could witness an extensive transformation in the coming years.