As announced by Prime Minister Narendra Modi yesterday, finance minister Nirmala Sitharaman is now releasing details of the ₹20 lakh crore economic package to revive the economy hit by the coronavirus pandemic. Aimed at all sections of the society, including the middle-class, SMEs, labourers, farmers and the industry, the economic package is themed around the ‘Self-reliant India campaign’. Sitharaman is expected to announce details of the full economic package gradually over the next few days with the first tranche being announced today. Both the Reserve Bank of India (RBI) and the finance ministry had already announced some relief measures in the first phase of the lockdown which began from March 25.

Key Points 20 Lakh Crore Economic Package

* With effect from May 14 till March 31, 2021, TDS/TCS (tax deducted at source/tax collected at source) has been reduced by 25% of the existing rate and is applicable to all payments. It will release Rs 50,000 crore in the hands of the people instead of paying them as taxes.

* Due date of all income-tax return for FY 2019-20 will be extended from July 31, 2020 & October 31, 2020 to November 30, 2020 and Tax audit from September 30, 2020 to October 31, 2020.

* Government announces Rs 3 lakh crore collateral free loans for MSMEs, having a 4 year tenure and moratorium of 12 months. These loans will be available till October 31, 2020 and will be 100 per cent credit guaranteed. This will help 45 lakh units to resume activity and safeguard jobs.

* To provide stressed MSMEs with equity support, government will facilitate provision of Rs 20,000 crore as subordinate debt.

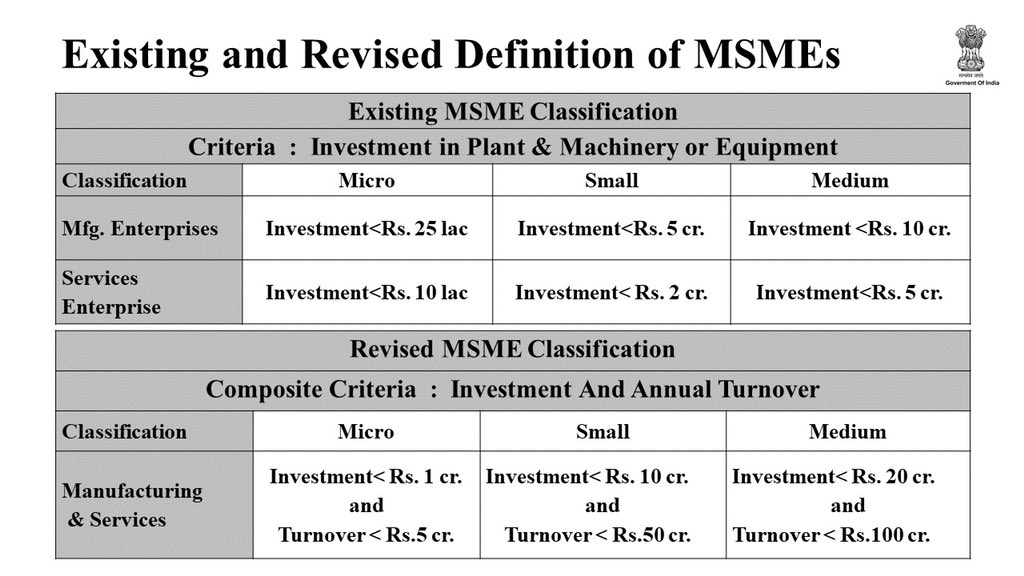

* MSMEs definition has been changed so that they need not worry about growing in size and still avail of the benefits.

* Investment limit which defined an MSME has been revised upwards to Rs 1 crore as compared to Rs 25 lakh earlier.

* Equity infusion of Rs 50,000 crore for MSMEs through fund of funds to be operated through a Mother Fund and few daughter funds. This will help to expand MSME size as well as capacity.

* Global tenders will be disallowed in government procurement for tenders up to Rs 200 crore. This will make self-reliant India, will also then be able to serve ‘Make in India’.

* Within the next 45 days all MSME receivables will be cleared by CPSEs and government of India.

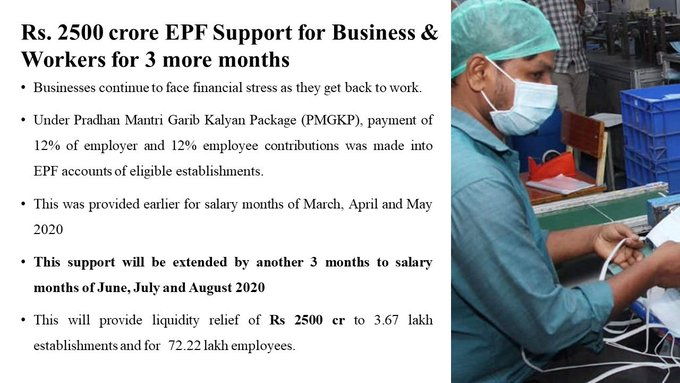

* EPF support for business and workers has been extended for the next 3 months, providing liquidity relief of Rs 2,500 crore. Statutory PF contribution is being reduced to 10 per cent from 12 per cent.

* From May 14 to March 31, 2021 TDS rate has been reduced by 25% of the existing rate and is applicable to all payments. It will release Rs 50,000 crore in the hands of the people instead of paying them as taxes.

* Special liquidity scheme of Rs 30,000 crore for NBFCs/HFCs/MFIs has been launched.

* One time liquidity infusion of Rs 90,000 crore has been made for all power distribution companies.

* Government announces Rs 45,000 crore liquidity infusion through a Partial Credit Guarantee Scheme 2.0 for NBFCs.

* In a major relief to contractors, all Central agencies to provide an extension of up to 6 months, without cost to contractor, to obligations like completion of work covering construction and goods and services contracts.

* Essentially the package is to spur growth and enhance demand and to create an atmanirbhar (self-reliant) India.

* PM laid out a comprehensive vision, and that vision was laid out after wide consultations with several sections of the society.

* Five pillars of a self-reliant India are: Economy, infrastructure, system, demography and demand. * Intention is to make local brands and take it into global level.

* Self-reliant India does not require India to be an isolationist country.