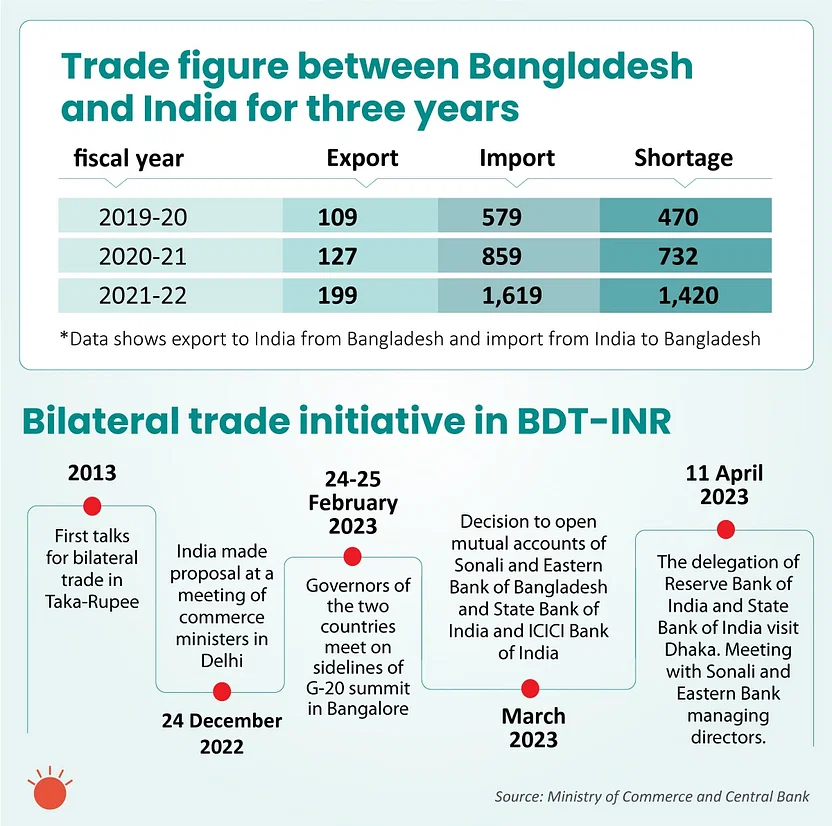

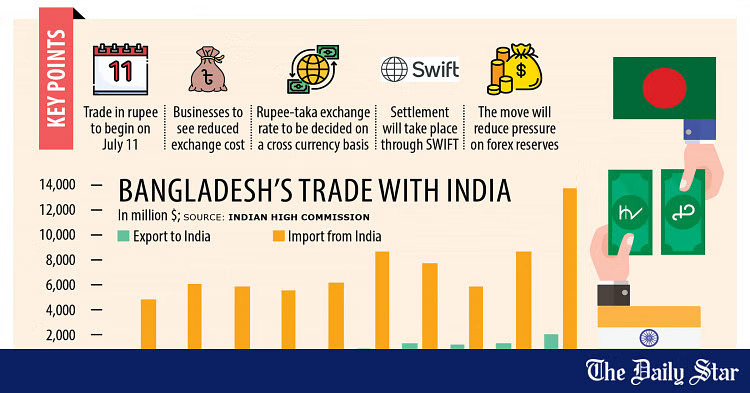

Bangladesh is scheduled to settle trade with India in Rupees beginning Tuesday, reducing their dependency on the American currency, which was involved in about 90% of worldwide FX transactions in 2022. Bangladesh Bank and the Indian High Commission are anticipated to make an announcement on the Indian currency.

According to a Bangladesh Bank (BB) official, the central bank governor and the Indian high commissioner will also attend the event. The Bangladesh Bank (BB) has previously granted permission to three banks in Bangladesh – Sonali Bank, Eastern Bank, and State Bank of India (SBI) – to open nostro accounts with their counterparts in the neighbouring country.

What are Nostro Accounts?

The nostro account is a foreign bank account kept by a bank in the currency of the nation where the funds are held. It is used to facilitate foreign exchange operations and international trade involving foreign currencies. This new action will open letters of credit in the rupee to source a portion of the products from the neighbouring country, reducing the use of the US dollar to some level.

Need for De-Dollarisation

The government has tightened import controls in response to a scarcity of US dollars caused by increasing import bills, in order to prevent further depletion of the foreign currency reserve, which has decreased by roughly 30% year on year. The private commercial bank, Eastern Bank, and the SBI country office have already created Nostro accounts with Indian ICICI Bank and SBI, according to the BB official, who added that state-run Sonali Bank will open the account as soon as possible.

Also read: India-Bangladesh Relations: SSB Interview Lecturette Topic 2023

Both the BB and the Reserve Bank of India (India’s central bank) have authorised the two Indian banks to begin settling bilateral commerce in Indian rupees (INR), he noted. The new agreement will allow Bangladesh to conduct foreign trade with India for USD 2 billion, which is equal to the country’s existing annual export receipts. According to The Daily Star, BB Governor Abdur Rouf Talukder stated last month that if unauthorised dealings are included, imports might reach USD 27 billion. ICICI Bank and SBI intend to pay imports with Bangladesh in rupees. And the funds will be transferred to the two Bangladeshi banks’ nostro accounts.

In the second phase, Bangladeshi banks will settle import payments on behalf of local importers using rupees deposited with counterparts. The US Dollar’s supremacy has waned during the last few decades. At the March conference of ASEAN finance ministers and central banks in Indonesia, policymakers considered reducing their reliance on the US dollar, Japanese yen, and euro and instead “moving to settlements in local currencies.”

To crack the SSB Interview, You can join our SSB interview live classes batch and we recommend you to Enroll SSB INTERVIEW ONLINE COURSE. Trusted by thousands of defence aspirants.