The Chinese economy has been suffering various headwinds that have pushed the world’s second-largest economy into deflation, including slow consumer spending, the unravelling of the real estate crisis, and decreasing exports. Consumer prices in China declined for the first time in more than two years, signalling further weakening demand and increasing Beijing’s troubles.

Chinese Economy: Fall in Consumer Price Index

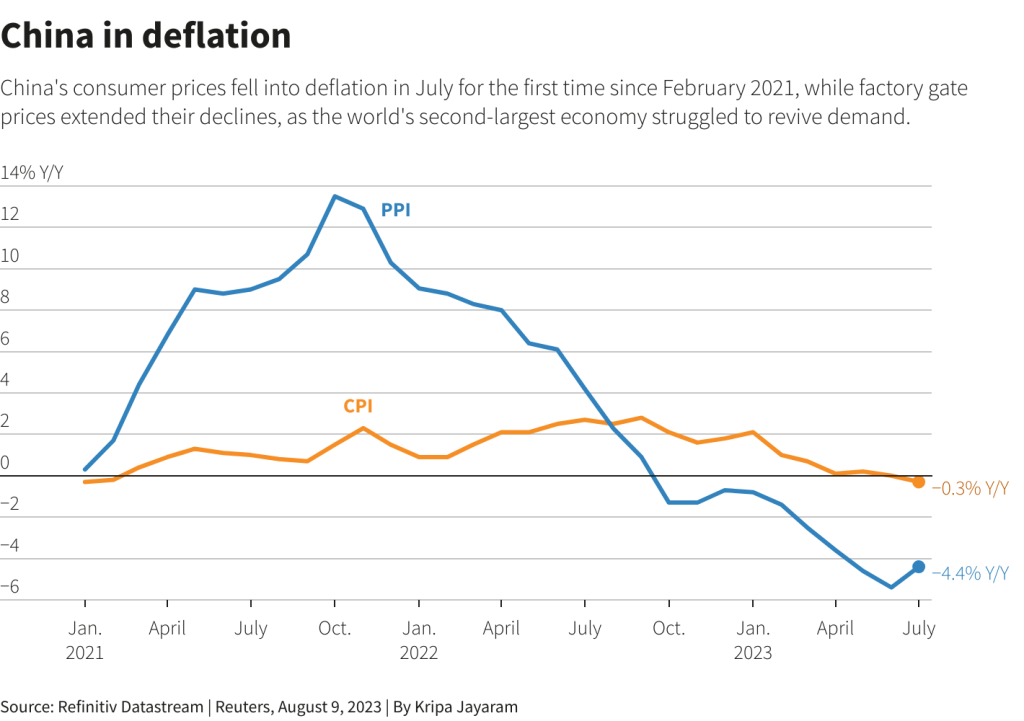

According to China’s National Bureau of Statistics, the consumer price index (CPI) declined 0.3% in July compared to the previous year. Notably, this is the first drop in the index since February 2021. In July, the prices of food, transportation, and home products all fell.

The producer price index (PPI), which gauges goods prices at the factory gate, fell by 4.4% in July compared to the previous year. It was the tenth consecutive month of PPI declines and the first time since November 2020 that consumer and producer prices fell in the same month.

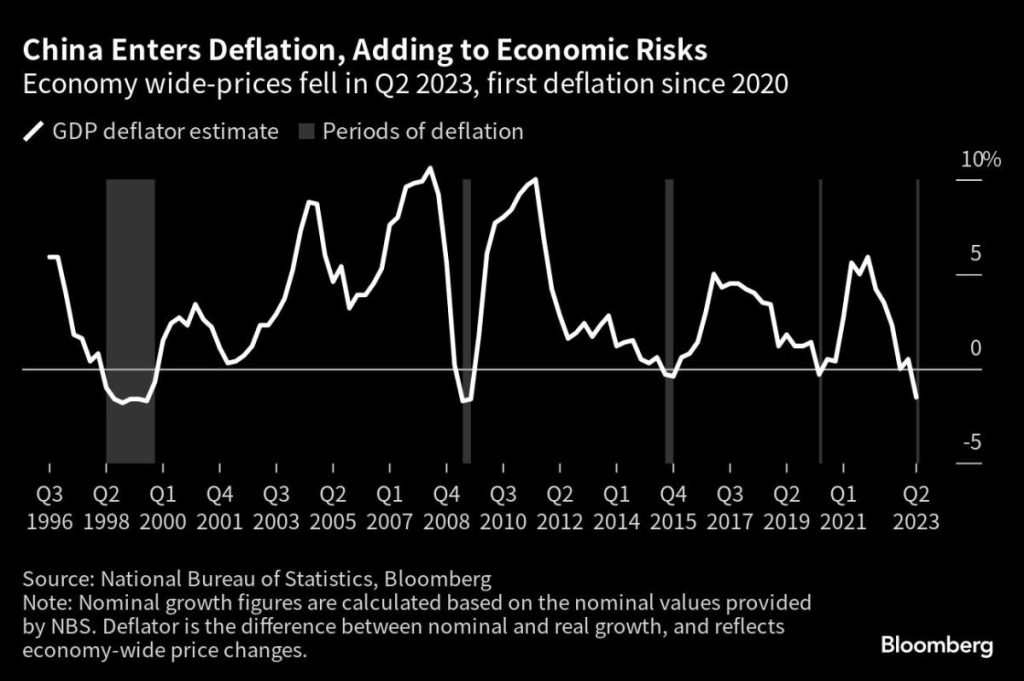

Meanwhile, indicators of deflation have been increasingly common in the world’s second-largest economy in recent months, raising fears that China would enter a prolonged period of stagnation. Evidence of combined consumer and producer price deflation undoubtedly endorses the notion of a broad-based economic slowdown in China.

China’s GDP hardly increased from April to June as compared to the prior quarter. This came after an early surge in economic activity caused by the removal of pandemic restrictions late last year waned. Beijing is likewise dealing with a lengthy real estate recession and sluggish trade.

China avoided the massive Covid-era support seen in industrialised economies. While this helped them avoid the uncontrolled inflation observed elsewhere. The disposable household income declined as salaries and property asset values both stopped, citing UBS analysts from a recent research note.

The Chinese government has also tinkered with interest rates, promised more support for the private sector, and taken gradual moves to strengthen the property market, but these measures have done little to jump-start the economy. Analysts believe that Beijing must implement more aggressive initiatives to restore trust and increase consumer spending.

Chinese Economy: What is Deflation?

Deflation is defined as a drop in the overall price of goods and services. Consumers can buy more with their money as currency purchasing power improves over time, but this does not translate into profit for businesses, forcing them to offer their products or services for less.

Chinese Economy: What factors contribute to deflation?

The first reason is a reduction in aggregate demand, which is the entire amount of goods and services that consumers and businesses are willing to purchase. This is more likely to occur during a recession when people feel less confident about the economy and are less eager to spend money.

An increase in aggregate supply, which is the entire amount of products and services available for sale by firms. This can occur when firms become more efficient, allowing them to create more goods and services at a reduced cost. A reduction in the money supply, or the amount of money in circulation. When central banks raise interest rates or sell government bonds, this can occur.

Why is China Experiencing Deflation?

A variety of causes have contributed to China’s deflationary spiral. The continuing instability in the real estate business is one example. For many years, the real estate sector has been a primary source of growth in China, but it has been badly affected by a combination of events, including the government’s debt crackdown and a worldwide economic recession. This has resulted in a dramatic drop in house prices, which has hampered consumer spending.

The sluggish global economy is another element contributing to deflation. China’s exports have been battered by a drop in demand from abroad markets, which is a significant source of cash for Beijing. As a result, China’s output and investment have slowed.

To crack the SSB Interview, You can join our SSB interview live classes batch and we recommend you to Enroll SSB INTERVIEW ONLINE COURSE. Trusted by thousands of defence aspirants.