In Current Affairs for 13 February 2025, we will see the latest national and international current affairs news. These important current affairs will be beneficial for your upcoming NDA, CDS, CDS OTA, AFCAT, TA, Agniveer Army, Agniveer Navy, Agniveer Air Force, Women Military Police, INET, MNS, ACC exams, SCO, PCSL, CAPF, and SSB interviews, and direct entries for Army, Navy, and Air Force like SSC Tech, TGC, JAG, NCC, TES, 10+2 Cadet. Download a PDF file about current events at the end of this article. Let us now see the Current Affairs.

Current Affairs 13 February 2025

World Radio Day

- World Radio Day. Every year on 13th February, World Radio Day is observed to raise awareness among the people about the importance of radio and to encourage access to information through radio. It is also a day to remember the unique power of radio which touches lives and brings people together from every corner of the globe.

- This year the World Radio Day theme is – Radio and Climate Change. In her message on World Radio Day, Director General of UNESCO Audrey Azoulay said, that World Radio Day is an opportunity to celebrate this enduring, versatile and widely accessible means of communication.

- She said, this year, we are paying tribute to the different ways radio serves as a tool for adapting to and mitigating the effects of climate disruption in the rapidly changing world. motto of Bahujan Hitaya Bahujan Sukhaya, Akashvani which is the biggest radio network in the world, is reaching the people of the country.

PM Modi Arrives In Washington

- After his successful visit to France, Prime Minister Narendra Modi reached Washington DC in the second leg of his two-nation tour where he will hold bilateral talks with US President Donald Trump.

- India’s Ambassador to the US Vinay Mohan Kwatra and other officials welcomed Prime Minister Modi at the airport. Members of the Indian community braved the harsh winters and gathered outside Blair House to welcome Mr. Modi who is among the first few world leaders to visit the United States following the inauguration of the US President.

- Before departing for his visit, Mr Modi noted that his visit to the US would be an opportunity to build on the successes of collaboration in his first term and develop an agenda to further elevate and deepen the partnership between the two nations.

Income Tax Bill

- New Income Tax Bill is expected to be tabled in Parliament on February 13, 2025. It aims to simplify the existing Income Tax Act, 1961, making tax laws more understandable for the common taxpayer and reducing litigation. Over the years, the Income Tax Act, 1961 has undergone modifications through 66 Budgets (including two interim Budgets), making it increasingly complex.

- While the new tax bill intends to bring clarity, many taxpayers are concerned about its actual impact. The government has introduced the new Income Tax Bill, 2025, to modernize and streamline taxation laws. The new bill focuses on simplifying language, restructuring sections, and improving compliance for individual taxpayers and businesses alike.

- Introduction of the ‘Tax Year’ Concept : The new Income Tax Bill is expected to introduce the concept of a Tax Year, merging the terms Assessment Year (AY) and Financial Year (FY). This aims to reduce confusion among taxpayers when filing their Income Tax Returns (ITRs) and depositing taxes.

- Financial Year Remains Unchanged : While the Tax Year concept is new, the Financial Year (FY) will continue to run from April 1 to March 31. The new tax bill will not align the tax year with the calendar year. Changes in Section Numbers

- To improve readability, the section numbers in the Income Tax Act will change. For instance: ITR filing (previously under Section 139) may be renumbered.

- New tax regime (previously under Section 115BAC) may have a different reference. This restructuring aims to create a more logically ordered tax code.

- No Changes in Residency Laws : The residency laws determining whether an individual is an Ordinarily Resident, Non-Ordinarily Resident, or Non-Resident remain unchanged. However, tax experts believe these laws should be reformed, as they currently require looking back 10 years to determine residential status.

- Comprehensive Tax Law Expansion : The new Income Tax Bill is significantly more detailed than the 1961 Act: Current Income Tax Act: 298 sections, 14 schedules.

- New Income Tax Bill: 536 sections, 16 schedules (over 600 pages). This restructuring enhances clarity while integrating digital governance and compliance mechanisms.

- Simplified Interpretation for Taxpayers : Removal of complex legal jargon such as explanations and provisos. Introduction of a single section for all salary deductions (e.g., standard deduction, gratuity, leave encashment). Straightforward depreciation formula for businesses.

- Easier TDS Compliance : All TDS-related provisions are consolidated under one clause. While this simplifies compliance, businesses may need to update their tax reporting systems to align with the new structure.

- No Changes in ITR Filing Deadlines, Tax Slabs, or Capital Gains : Despite expectations, the new bill does not alter tax slabs, ITR filing deadlines, or capital gains taxation. This ensures stability and predictability in tax planning.

- Stricter Penalties for Non-Compliance : Higher fines for late tax filings and non-compliance. Improved AI-based scrutiny to detect tax evasion.

- Implementation from April 1, 2026 : The new Income Tax Bill is expected to be implemented from FY 2026-27 (April 1, 2026). Tax calculations for FY 2024-25 and FY 2025-26 will still be governed by the existing Income Tax Act, 1961.

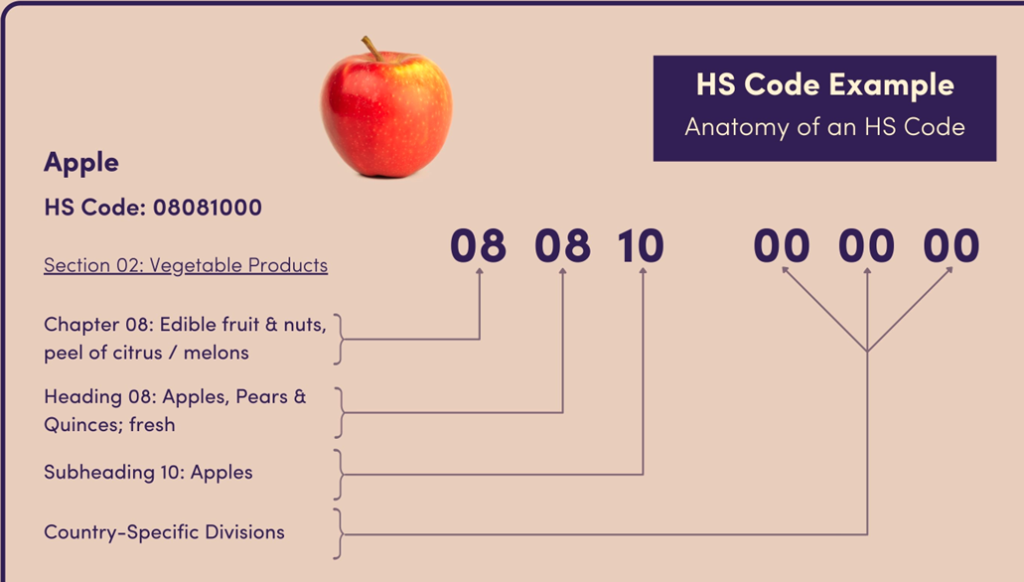

India Introduces New HS Code For Rice Varieties

- India’s Finance Minister Nirmala Sitharaman has come up with an amendment to the Customs Tariff Act to provide for an HS (Harmonised System) code, for the export of geographical indication (GI) recognised rice.

- It is the first time in the world that an HS code has been introduced for GI-recognised rice . The amendment was introduced in the Budget proposals for the2025-26 financial year on February 1, under HS Code 1006-30-11 (parboiled) and 1006-30-91 (white).

- The Indian Patent Office has given a GI tag to 20 rice varieties. The GI-tag recognised varieties are Navara, Palakkadan Matta, Pokkali, Wayanad Jeerakasala, Wayanad Gandhakasala, Kalanamak, Kaipad, Ajara Ghansal, Ambemohar, Joha, Gobindobog, Tulapanji, Katarni and Chokuwa rice varieties.

- These varieties got the GI tag before March 2020. HS assigns specific six-digit codes for varying classifications and commodities. Countries are allowed to add longer codes to the first six digits for further classification.

- HS is governed by “The International Convention on the Harmonized Commodity Description and Coding System”. HS Committee, made up of member countries, oversees the HS classification system and also updates HS every 5 – 6 years.

Spice Start Up Conclave

- ICAR-Indian Institute of Spices Research (IISR), Kozhikode, will be organising a startup conclave — Rise Up– from February 19 to 21. The objective of the event is to generate innovative ideas and foster entrepreneurship in spice cultivation, processing and value addition.

- The three-day conclave will have sessions on themes including the potential of innovations, the future of spice-based entrepreneurship, and technological advancements in the spice industry.

- Organized in collaboration with Kerala Startup Mission, the Ideathon invites students, entrepreneurs and startups to submit their ideas online by February 15. Each team may have up to five members.

- Submitted ideas will be reviewed initially by a panel of experts and the selected ideas can be presented on the first day of the event at IISR. The total prize pool for the event is ₹1,00,000, and further support will be provided by the research institution for the development of promising ideas.

Indigenous Chip for Space

- Indian Space Research Organisation (ISRO) and the Indian Institute of Technology Madras (IIT Madras) have collaboratively developed and successfully booted an indigenous semiconductor chip named ‘IRIS’ (Indigenous RISC-V Microprocessor for Space Applications).

- This development aligns with the ‘Atmanirbhar Bharat’ initiative, aiming to reduce dependence on foreign technology in critical sectors. The ‘IRIS’ chip is derived from the ‘SHAKTI’ microprocessor project, which is based on the open-source RISC-V Instruction Set Architecture (ISA).

- SHAKTI project, led by Prof. V. Kamakoti at IIT Madras, focuses on creating customizable processors for various applications. The ‘IRIS’ chip is tailored for space applications, including command and control systems, and can also be utilized in domains such as the Internet of Things (IoT) and computing systems for strategic needs.

- ISRO Inertial Systems Unit (IISU) in Thiruvananthapuram proposed the concept of a 64-bit RISC-V-based controller and collaborated with IIT Madras to define the specifications and design of the semiconductor chip. The design addressed common functional and computing requirements of existing sensors and systems used in ISRO missions.

- Fault-tolerant internal memories were integrated to enhance reliability, and custom functional and peripheral interface modules were included to meet specific space system needs.

- ‘IRIS’ chip’s development is noteworthy because it was entirely conceived, designed, and manufactured within India. The chip design and implementation were carried out by IIT Madras, fabrication was done by the Semiconductor Laboratory (SCL) in Chandigarh, packaging by Tata Advanced Systems Ltd. in Karnataka, and the motherboard was manufactured by PCB Power in Gujarat.

- This end-to-end indigenous development exemplifies India’s capabilities in semiconductor design and fabrication, marking a significant milestone in the ‘Make in India’ initiative.

Current Affairs 13 February 2025 Question

- Which Country Is The Host Of Artificial Intelligence (AI) Action Summit 2025

A. France

B. India

C. Russia

D. United States

ANSWER: A - India’s First Indigenous Automated Biomedical Waste Treatment Plant Has

Been Launched In Which City

A. Chennai

B. Hyderabad

C. New Delhi

D. Kolkata

ANSWER: C - R-37M Missile Is Developed By Which Country

A. Australia

B. India

C. Russia

D. France

ANSWER: C - Lumpy Skin Disease Is Mostly Occurred In Which Species/Group

A. Birds

B. Cattle

C. Mammals

D. None of the Above

ANSWER: B - Where Was The Third Edition Of India Energy Week Held

A. Jaipur

B. New Delhi

C. Chennai

D. Bhopal

ANSWER: B - South Georgia Island, Lies In Which Ocean

A. Pacific Ocean

B. Arctic Ocean

C. Atlantic Ocean

D. Arctic Ocean

ANSWER: C - Which Country Is Host Of BRICS Youth Council Entrepreneurship Working

Group Meeting 2025

A. Brazil

B. China

C. South Africa

D. India

ANSWER: D - Who is collaborating with ICAR-IISR to organize Spice Start Up Conclave

A. NITI Aayog

B. Ministry of Agriculture

C. Indian Chamber of Commerce

D. Kerala Startup Mission

ANSWER: D - What Is The Theme Of The Third Edition Of The Kashi Tamil Sangamam

A. Ancient Temples of Tamil Nadu

B. Bhakti Movement

C. Sage Agasthiyar

D. Tamil Literature

ANSWER: C - Name Of The Sports Drink Recently Launched By Reliance Consumer Products

A. PowerPlay

B. Hydrate Plus

C. Spinner

D. SportyFizz

ANSWER: C - What Amendment Has Been Made To The Customs Tariff Act By India’s

Finance Minister Nirmala Sitharaman

A. Reduction of import duty on rice

B. Introduction of an HS code for GI-recognised rice

C. Increase in export duty on rice

D. Tax exemption for rice exports

ANSWER: B - India’s Sustainable Aviation Fuel Blend Target International Flights By 2027

A. 4%

B. 1.5%

C. 2%

D. 1%

ANSWER: D - Which State Will Host The 39th Edition Of The National Games In 2027

A. Uttarakhand

B. Assam

C. Meghalaya

D. Manipur

ANSWER: C - On Which Date Is The International Day Of Women And Girls In Science

Celebrated Annually

A. February 15

B. February 11

C. February 12

D. February 13

ANSWER: B - On Which Date Did Donald Trump Declare ‘Gulf Of America Day

A. February 9

B. January 20

C. March 15

D. April 5

ANSWER: A - In Which City India’s First Automated Biomedical Waste Treatment Rig,

“Sṛjanam,” Inaugurated

A. Mumbai

B. New Delhi

C. Bengaluru

D. Chennai

ANSWER: B - What Is New Name Of The Hindustan Jet Trainer (HJT-36) After Modifications

A. Vajra

B. Dhruv

C. Rudra

D. Yashas

ANSWER: D - What Type Of Rice Has India Introduced New HS Codes To Facilitate Exports

A. GI-Tagged Rice

B. Basmati Rice

C. Hybrid Rice

D. Non-Basmati Rice

ANSWER: A - How Many New Languages Added To The Lok Sabha Translation Service

A. 4

B. 5

C. 6

D. 7

ANSWER: C - Terms Such As ‘Placement, Layering, Integration Of Funds’ Are Related To

Which Among The Following

A. Fiscal Management

B. Financial Stability

C. Money Laundering

D. Capital Market Trading

ANSWER: C