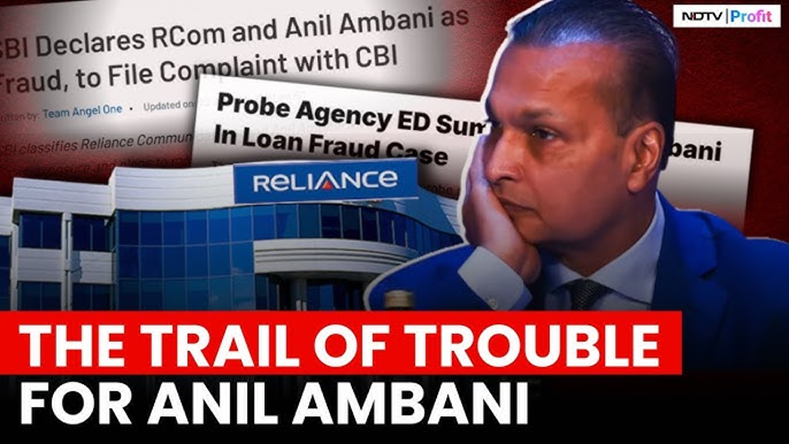

Enforcement Directorate (ED) has issued a Lookout Circular (LOC) against Anil Ambani, asking him to appear before the federal agency on August 5. Ambani, 66, the younger brother of Reliance Industries Limited (RIL) Chairman Mukesh Ambani, has also been barred from leaving the country. Recently, the ED conducted raids at locations linked to Anil Ambani. Anil Ambani has been summoned for questioning at its headquarters in Delhi to record his statement under the Prevention of Money Laundering Act (PMLA).

Anil Ambani Summoned By ED In ₹17,000 Crore Loan Fraud Investigation

Why In News

- Enforcement Directorate (ED) has issued a Lookout Circular (LOC) against Anil Ambani, asking him to appear before the federal agency on August 5. Ambani, 66, the younger brother of Reliance Industries Limited (RIL) Chairman Mukesh Ambani, has also been barred from leaving the country.

- Recently, the ED conducted raids at locations linked to Anil Ambani. Anil Ambani has been summoned for questioning at its headquarters in Delhi to record his statement under the Prevention of Money Laundering Act (PMLA). Several executives from his group companies have also been summoned over the coming days.

What Is The Case Against Anil Ambani

- These summons follow the ED’s recent searches at 35 locations connected to 50 companies and 25 individuals, including executives from Ambani’s business group. The operation, which began on July 24, lasted for three days.

- The investigation centres around alleged financial irregularities and the diversion of over Rs 17,000 crore in loans by various companies in the Anil Ambani-led group, including Reliance Infrastructure (R Infra).

- Based on a report from the Securities and Exchange Board of India (SEBI), the ED found that R Infra allegedly routed funds to Reliance Group companies under the guise of inter-corporate deposits (ICDs) through a company named CLE. R Infra reportedly failed to disclose CLE as a “related party”, potentially bypassing the need for shareholder and audit committee approvals.

Reliance Infra’s Response To Charges

- A spokesperson for the Reliance Group responded to the allegations by stating that the claim involving Rs 10,000 crore in fund diversion dated back over a decade. The company clarified that its actual exposure was about Rs 6,500 crore, as reflected in its financial statements.

- This issue was publicly disclosed by Reliance Infrastructure on February 9, 2025, nearly six months ago. According to the statement, a full recovery of the Rs 6,500 crore exposure was achieved through a mediated settlement led by a retired Supreme Court judge, with the award filed before the Bombay High Court.

- The company also noted that Anil Ambani has not been on the board of Reliance Infrastructure since March 2022, over three years ago.

What Course Of Action Is ED Likely To Follow

- Anil Ambani has been asked by the ED to report to its office in New Delhi for questioning linked to an investigation into a suspected loan fraud and money laundering case involving his group companies. The ED plans to take his statement under the law that deals with money laundering (PMLA).

- Last week, the ED raided 50 business entities and 25 individuals connected to the Reliance Group under the Prevention of Money Laundering Act (PMLA) while at least 35 locations in Mumbai were searched on July 24.

Case

- The money laundering case originates from at least two CBI FIRs and reports provided by the National Housing Bank, SEBI, the National Financial Reporting Authority (NFRA), and Bank of Baroda ED.