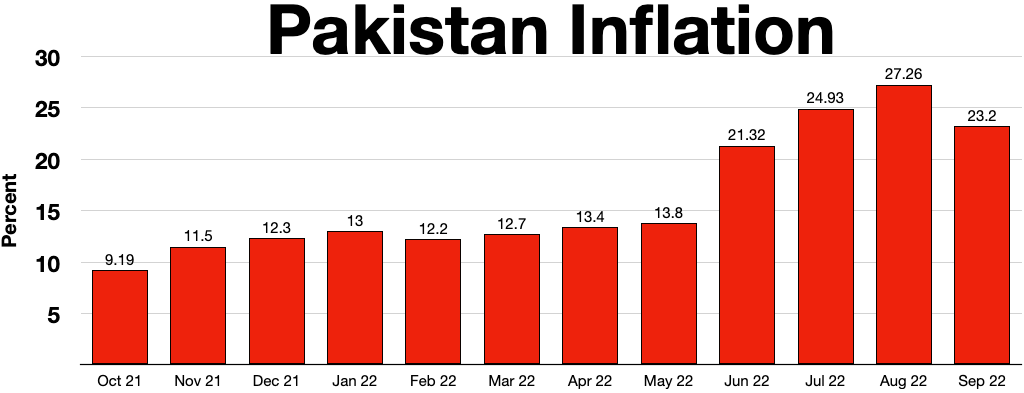

The continuing economic crisis in Pakistan is the product of last year’s political upheaval, which saw the administration removed by a vote of no confidence in 2022 by Pakistan’s parliament, and the following disruption in the country turned into a political drama. The country entered an economic crisis, with significant inflation forecast to remain around 33% in the first half of 2023, and the World Bank projected in the first week of April that almost 4 million Pakistanis would slip below the lower-middle-income threshold of $3.6 per day. The country’s shambles economy is undeniably problematic, and the country is relying on a few hopes to resolve the dilemma.

The IMF Agreement And Friendly Assistance From Other Countries

The IMF promotes spending restrictions, improved tax administration, and the elimination of subsidies and export tax breaks that benefit larger enterprises and cartels. The Pakistani rupee has lost ground to the US dollar, fuelled in part by a surge in interest in smuggling cash into neighboring Afghanistan. Minister Dar most likely failed to foresee a strong rupee before returning to Pakistan from his perch in London. Dar outperformed former finance minister Miftah Ismail, who appeared to be optimistic about reaching an agreement with the IMF in June 2022.

Also read: Pakistan Economic Crisis 2023: SSB Interview Topic [Fully Explained]

The IMF plan fell through, and Ismail was fired shortly after Dar arrived in Pakistan. Since early February, Islamabad has been negotiating with the IMF for $1.1 billion in aid as part of a $6.5 billion rescue package agreed upon in January 2019. The IMF inflows did not arrive until late March 2023, and April has become the cruelest month for Pakistan, with scenes of the IMF accord failing and a government debt default taking place.

US President Joe Biden has recommended doubling Pakistan’s economic support budget to USD 82 million for 2024 to aid in the country’s recovery from devastating floods, improve electricity supplies, and develop projects. Under the Economic Support Fund proposal, the budget plans to give Pakistan USD 82 million starting in October 2024. In 2022, the assistance was worth USD 39 million. The debt-trapped Pakistani government is currently in a race against time to implement steps agreed upon with the IMF, despite the country allegedly having insufficient reserves.

The agreement with the IMF on the completion of the ninth review of a USD 7 billion loan Extended Fund Facility program, which has been postponed since before the end of last year over a policy structure, would not only result in a 1.2 billion payment but would also open the door to inflows from friendly states. Economically shackled, Pakistan has received a gesture from Saudi Arabia to subsidize an additional USD 2 billion, a move that will assist the country in obtaining much-needed IMF assistance.

The Saudi leadership intends to make a public declaration, most likely during Prime Minister Shahbaz Sharif’s imminent visit to the Kingdom. Pakistan’s leadership is also waiting for assistance from the UAE on an additional USD 1 billion reserve in order to move forward with a staff-level agreement with the IMF. The assistance from Riyadh comes at a vital moment since the IMF program, which was signed in 2019, will expire on June 30, 2023, and the program cannot be extended past that date under the stipulated rules. Pakistan received a USD 2 billion rollover credit from its long-time friend China last month, which will assist shore up the country’s depleted foreign exchange reserves.

What Should Be Done?

Pakistan is currently on the verge of a dystopian situation, having been in danger for some time. There have been red signs, such as a dismal ranking in the Worldwide Governance Indicators or the Fragile States Index. The economy is undoubtedly in a horrible state, with businesses and industries closing and inflation growing over a reasonable level, and the country’s banks are also in a bad state. Pakistan recently shut down some Chinese enterprises in Karachi as “preventive” steps in response to the deteriorating security situation. There have been rumors that China is infiltrating the country through business initiatives and other financial interests.

Also read: The Perpetual Rivalry: Examining The Future Of India-Pakistan Relations

With so many obstacles in the way, the issue is, can anything be done to turn things around, or is it too late? The reliance on a return to constitutional government and a neutral setup can be made, but the answer revolves around what needs to be done rather than taking political steps forward. The solution window has undoubtedly shrunk, and a succession of crises can be predicted to have unfavorable outcomes. An IMF agreement is undoubtedly what Pakistan requires; but, internal analysts believe the government will face difficulties, as the IMF is expected to demand severe belt-tightening, which would be unpopular among voters who are already dealing with decades of high inflation and fewer employment opportunities. If the disbursements do not arrive by June, there may be a six-month vacuum until the next administration enters office, during which Pakistan’s people will be starved of funding, thereby bringing it to the verge of starvation.

To crack the SSB Interview and join the Indian Army as an Officer, You can join our SSB interview live classes batch and we recommend you to Enroll SSB INTERVIEW ONLINE COURSE. Trusted by thousands of defence aspirants.