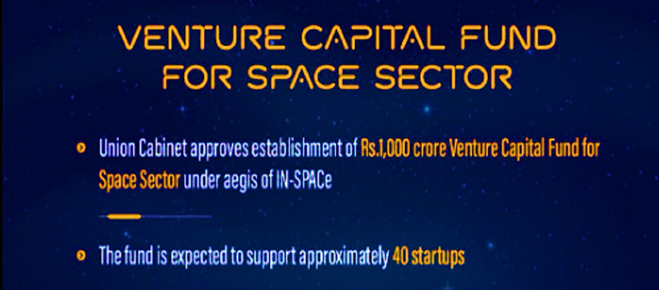

Union Cabinet, led by Prime Minister Narendra Modi, has approved the establishment of a Rs.1,000 crore Venture Capital (VC) Fund dedicated to supporting India’s space sector. This pioneering initiative, developed under the aegis of IN-SPACe (Indian National Space Promotion and Authorization Center), aims to propel the growth of space startups, strengthen India’s space economy, and position the country as a global leader in space technology.

Empowering India’s Space Economy Rs.1K Crore Venture Capital Fund

Why In News

- Union Cabinet, led by Prime Minister Narendra Modi, has approved the establishment of a Rs.1,000 crore Venture Capital (VC) Fund dedicated to supporting India’s space sector. This pioneering initiative, developed under the aegis of IN-SPACe (Indian National Space Promotion and Authorization Center), aims to propel the growth of space startups, strengthen India’s space economy, and position the country as a global leader in space technology.

- The establishment of this fund aligns with the government’s broader vision of promoting innovation, ensuring economic growth, and fostering self-reliance in high-tech industries, thus supporting the goals of Atmanirbhar Bharat.

Objectives

- Fund aims to achieve the following objectives:

- Capital Infusion: The capital fund is expected to encourage additional funding for later-stage development, instilling market confidence and providing early-stage financial support critical for growth.

- Talent Retention and Domestic Development: Many Indian startups relocate abroad due to better financial opportunities. The fund will work to retain talent within India, preventing brain drain and fostering the growth of homegrown space companies.

- Five-Fold Expansion of Space Economy: The government aims to grow India’s space economy by five times over the next decade, supporting the establishment of India as a major global player in space technology.

- Technological Advancements: Investment in innovation will help advance space technology, supporting the development of sophisticated solutions for both domestic and international markets.

- Boosting Global Competitiveness: Enabling Indian companies to develop unique space-based solutions will reduce dependency on foreign technology and allow for stronger competition on a global scale.

- Supporting Atmanirbhar Bharat: By investing in indigenous startups, the fund underscores India’s commitment to self-reliance, fostering a robust domestic space economy with fewer dependencies on external technology.

- Creating a Vibrant Innovation Ecosystem: The fund seeks to foster a dynamic space innovation ecosystem by nurturing startups and fostering collaborations between various sector. This environment encourages the development of new ideas, products, and technologies, stimulating a continuous cycle of innovation in the Indian space industry.

- Driving Economic Growth and Job Creation: By supporting startups and entrepreneurs in the space sector, the fund is expected to boost economic activity, leading to the creation of thousands of direct and indirect jobs. It will enable companies across the supply chain to scale operations, thus enhancing India’s competitive position in the global space economy.

Role of IN-SPACe

- Indian National Space Promotion and Authorization Center (IN-SPACe) was established in 2020 as part of the government’s comprehensive space sector reforms. Its purpose is to promote and oversee private sector involvement in space activities, serving as a key facilitator for space startups and businesses. IN-SPACe has been instrumental in initiating reforms that align with the government’s goals of enhancing space technology, increasing private participation, and expanding India’s share in the global space economy.

- The VC Fund was proposed by IN-SPACe to address the critical lack of risk capital in the high-tech space sector, which is essential to sustain growth and enable Indian companies to compete internationally. Traditional lenders often hesitate to support space-related startups, considering the high risk involved and the long-term horizon of returns.

- The VC Fund, therefore, represents a government-backed initiative designed to bridge this funding gap, empowering startups to thrive in a high-risk environment with strong growth potential.

Positioning India As A Global Space Economy Leader

- At present, the Indian space economy is valued at approximately USD 8.4 billion, constituting a 2% share of the global space market. The government envisions scaling the space economy to USD 44 billion by 2033, including US $11 billion in exports amounting to 7-8% of the global share.

- This growth is anticipated to be driven by private sector participation, including a promising pipeline of around 250 startups currently operating across various segments of the space economy in India.

- Many countries have recognized the strategic importance of the space sector and established space-focused VC funds to drive innovation, foster private-sector participation, and strengthen national capabilities. Examples include 30 million GBP Seraphim Space Fund of UK, 86 million Euro Primo Space Fund of Italy, US $6.7 billion Space Strategic Fund of Japan and Neo Space Group (NSG) by Public Investment Fund (PIF), Saudi Arabia.

- Through its VC Fund, India aims to adopt a similar approach, supporting its startups and fostering a strong space innovation ecosystem while driving the local development of space technology and related services.

Conclusion

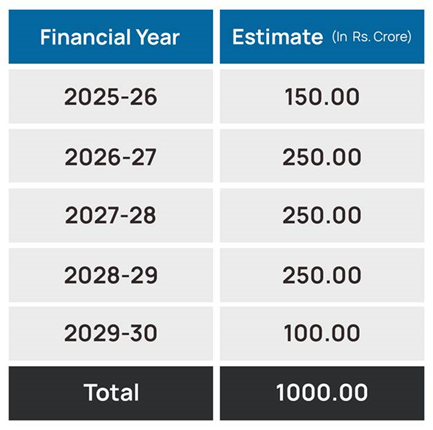

- Rs. 1,000 crore VC Fund under IN-SPACe signifies a milestone in India’s space sector evolution, demonstrating the government’s commitment to achieving self-reliance and establishing India as a global leader in space.

- By providing risk capital, creating jobs, fostering innovation, and encouraging private sector participation, the fund aligns with national priorities to strengthen India’s capabilities in the high-tech domain. It is not only a financial commitment but also a long-term strategic investment in building a vibrant, innovative, and sustainable space economy that aligns with the goals of Atmanirbhar Bharat.