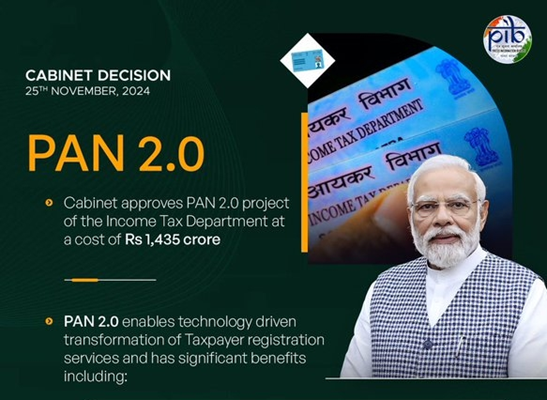

Union Minister Ashwini Vaishnaw announced that the government was all set to introduce PAN 2.0. The Cabinet Committee on Economic Affairs (CCEA), chaired by Prime Minister Narendra Modi, has approved the Income Tax Department’s PAN 2.0 Project. The project will make the permanent account number a “common business identifier” for all government agencies’ digital systems. The move is in line with the central government’s flagship programme, Digital India.

What Is PAN 2.0 ? How Does It Differ From Old One ?

Why In News

- Union Minister Ashwini Vaishnaw announced that the government was all set to introduce PAN 2.0. The Cabinet Committee on Economic Affairs (CCEA), chaired by Prime Minister Narendra Modi, has approved the Income Tax Department’s PAN 2.0 Project. The project will make the permanent account number a “common business identifier” for all government agencies’ digital systems. The move is in line with the central government’s flagship programme, Digital India.

What is PAN

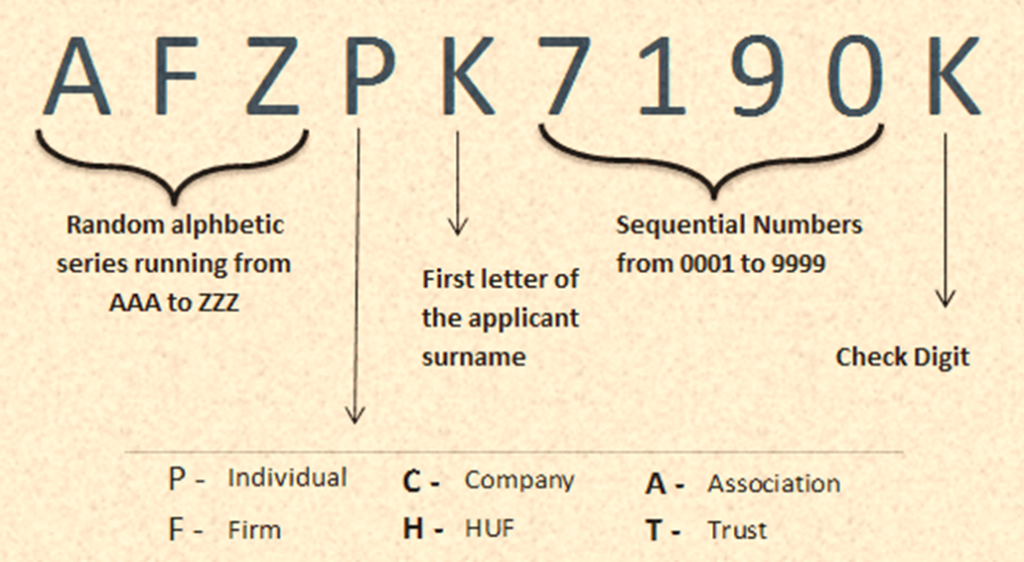

- PAN is an abbreviation of Permanent Account Number. The Income Tax Department of India assigns an alphanumeric, 10-digit unique number to each taxpayer. Each PAN number is unique and different for each individual.

- The PAN number keeps track of a person’s financial activities and is required for all forms of payment

- A PAN card appears to be a physical plastic card with one’s PAN number, name, DOB, and a photograph printed on it.

- PAN number is valid for life because it is unaffected by changes in address or job profile and can thus be used as proof of identity.

- The first five characters of the Permanent Account Number are always uppercase letters, followed by four numerals, and the tenth or final character is a letter. ‘AAA XX123 4B’ is an example.

- The PAN number’s first three characters form an alphabetic sequence.

- The fourth character identifies the cardholder type, which can be either an individual or a person. For instance, BBBPZ123XA.

What Is PAN 2.0 ?

- Permanent Account Number (PAN), introduced in 1972 under Section 139A of the Income Tax Act, serves as a unique taxpayer identification number.

- The PAN 2.0 Project represents a tech-driven upgrade to this decades-old PAN/TAN services system.

- It is an e-governance initiative for re-engineering the business processes of taxpayer registration services.

- The government will spend Rs 1,435 crore on the project that is aimed at enhancing taxpayer registration services.

- The revamped PAN will come with a QR code feature, enabling quick scans and full online functionality. This is a significant step towards an economic system that is entirely digital, secure, and effective.

- PAN 2.0 Project aims to enhance the taxpayer experience through faster services and improved efficiency.

How Will This Benefit taxpayers?

- PAN 2.0 Project aims to enhance the taxpayers’ digital experience through ease of access, faster services and improved quality.

- The new PAN will function as a universal identifier for business-related engagements across specified domains.

- Aligned with the government’s Digital India initiative, the project adapts an eco-friendly approach by using paperless systems and cost-optimised infrastructure.

- Vaishnaw, while announcing the decision, confirmed that the upgrades, including the addition of a QR code to PAN, will be rolled out free of cost to all taxpayers.

- It also offers enhanced security with upgraded digital infrastructure for better agility and protection. The project would consolidate core and non-core PAN/TAN activities into a unified ecosystem, enhancing validation services and making processes more robust.

- “The existing system will be upgraded and the digital backbone will be brought in a new way We will try to make it a common business identifier. There will be a unified portal, it will be completely paperless and online. The emphasis will be on the grievances redressal system,” Vaishnaw.

- He added, “The grievance redressal system is being updated. For the protection of data, a PAN data Vault System is being set up. With a unified portal, there will be no need to go to other portals.”

- Streamlined Processes: Simplified Taxpayer Registration And Services For Quicker Processing.

- Data Consistency: Serving As A Single Source Of Truth For Integrated Information Across Systems.

- Eco-Friendly Approach: Paperless systems and cost-optimized infrastructure.

- Enhanced Security: Paperless systems and cost-optimized infrastructure.

Do You Need To Apply For A New PAN Card

- No. The Cabinet ensures that a citizen’s existing PAN remains valid, despite the significant digital transformation. About 78 crore (98 per cent) of PANs have already been issued since 1972. This upgrade promises a better digital experience without asking existing PAN holders to do anything.

- While the Centre has not announced a specific timeline for the rollout, Vaishnaw asserted that PAN upgrades will be provided to individuals at no cost.