Reserve Bank of India’s (RBI) six-member Monetary Policy Committee (MPC) Friday cut the repo rate — the rate at which the RBI lends to other banks — by 25 basis points to 6.25 per cent. This is the first rate cut initiated by the RBI in five years, the last one being in May 2020. The repo rate, till now, stood at 6.5 per cent. The move comes barely a week after the Centre cut personal income tax to boost consumption.

RBI Cuts Repo Rate By 25 Basis Points To 6.25%

Why In News

- Reserve Bank of India’s (RBI) six-member Monetary Policy Committee (MPC) Friday cut the repo rate — the rate at which the RBI lends to other banks — by 25 basis points to 6.25 per cent. This is the first rate cut initiated by the RBI in five years, the last one being in May 2020. The repo rate, till now, stood at 6.5 per cent. The move comes barely a week after the Centre cut personal income tax to boost consumption.

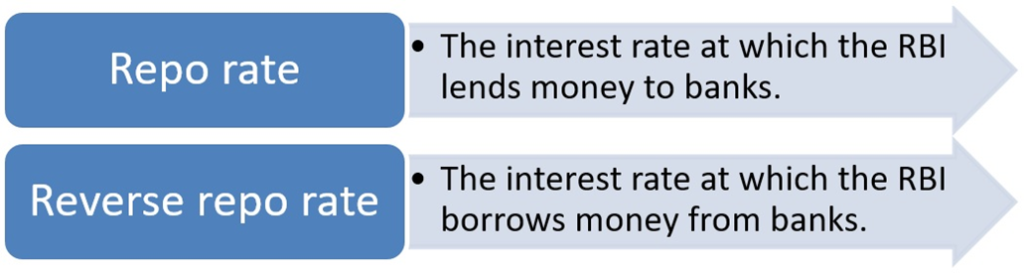

Repo Rate

Basis Points

- BPS or Basis Points Can Be Defined As A Measure Of Financial Instruments Price Change Or Interest Rate Change. One Bps Means 0.01 Percent Or 1/100th Of 1 Percent. So, If You See A Change Of 25 Bps In Interest Rate, This Means The Interest Rate Has Changed By 0.25%.

What Happens When Repo Rate Is Cut

- When the RBI reduces the repo rate, all external benchmark lending rates (EBLR) linked to the repo rate will come down, giving relief to borrowers as their equated monthly instalments (EMIs) will fall.

- Lenders may also reduce interest rates on loans that are linked to the marginal cost of fund-based lending rate (MCLR), where the full transmission of a 250 bps hike in the repo rate between May 2022 and February 2023 has not happened.

All You Need To Know

- RBI’s MPC, in a unanimous decision, lowered the repo rate in a bid to stimulate economic activity by making borrowing cheaper, thereby encouraging spending and investment. The MPC, however, decided to continue with its “neutral” stance for the economy, which RBI Governor Sanjay Malhotra explained would provide flexibility to respond to the evolving macroeconomic environment.

- Malhotra said that the framework has served the Indian economy very well over the years, including the very challenging period since the pandemic, and average inflation has been lower post the introduction of this framework. He added that since the introduction of the framework, CPI has been largely aligned to the target, barring a few occasions of breaching the upper tolerance band.

- RBI had last reduced the repo rate by 40 basis points to 4% in May 2020 to help the economy navigate the crisis caused by the Covid pandemic. Since then, the repo rate steadily increased until December 2022, with seven consecutive hikes bringing it to 6.5%. The RBI has maintained the status quo since February 2023.

What Will Be RBI Repo Rate Cut Impact On FDs

- RBI’s 25 basis points (bps) rate cut marks a shift from the high-interest rate regime that prevailed for the last four years, during which successive rate hikes pushed loan rates higher but also made fixed deposits (FDs) more attractive for savers. With borrowing costs rising, banks had to offer higher FD rates to attract deposits and maintain liquidity.

- However, with the latest rate cut, banks may start lowering FD interest rates in response to reduced lending rates, impacting investors —especially retirees and conservative savers — who have enjoyed strong returns on their deposits. While the impact may not be immediate, a sustained easing cycle could gradually bring FD rates down.

- Despite predictions that the RBI would implement a rate cut in the February monetary policy, several banks have recently hiked FD rates on certain plans. In the past month, banks such as Union Bank of India, Punjab National Bank (PNB), Axis Bank, Shivalik Small Finance Bank, Karnataka Bank, and Federal Bank have already revised their fixed deposit (FD) rates, offering higher returns to attract depositors.

Measures To Counter Cyber Frauds

- RBI Governor also listed out measures the central bank is taking to counter cyber frauds. “Rapid digitalisation of financial services has brought convenience and efficiency, but has also increased exposure to cyber threats and digital risks that are progressively getting sophisticated, Malhotra said.

- He also announced a couple of measures undertaken by the RBI to prevent such frauds — an additional factor of authentication being extended to online international digital payments made to offshore merchants, and the implementation of “bank.in” exclusive Internet domains for Indian banks and “fin.in” domain for the rest of the financial sector.

- The RBI’s exchange rate policy over the years has remained consistent and its stated objective is to maintain orderliness and stability without compromising forex market efficiency, Sanjay Malhotra said.

- He added: “The RBI’s intervention in the forex market is focussed on smoothening excessive and disruptive volatility, and it does not target any exchange rate level or band. The exchange rate of the Indian rupee is determined by market forces.”