GST Council headed by Union Finance Minister Nirmala Sitharaman decided to set up a Group of Ministers (GoM) to reduce the tax rate on life and health insurance and cut GST on cancer drugs and namkeens.

54th Meeting Of GST Council Highlights

Why In News

- GST Council headed by Union Finance Minister Nirmala Sitharaman decided to set up a Group of Ministers (GoM) to reduce the tax rate on life and health insurance and cut GST on cancer drugs and namkeens.

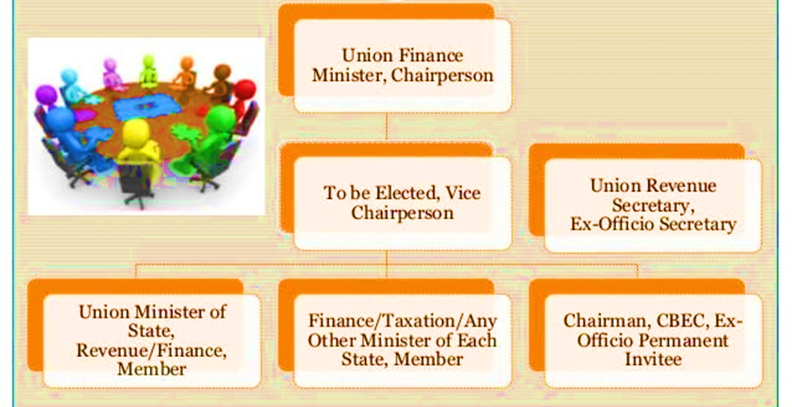

GST Council

- Goods and Services Tax regime came into force after the Constitutional (122nd Amendment) Bill was passed by both Houses of Parliament in 2016.

- More than 15 Indian states then ratified it in their state Assemblies, after which the President gave his assent.

- The GST Council is a joint forum of the Centre and the states.

- It was set up by the President as per Article 279A (1) of the amended Constitution.

- The members of the Council include the Union Finance Minister (chairperson), the Union Minister of State (Finance) from the Centre.

- Each state can nominate a minister in-charge of finance or taxation or any other minister as a member.

Highlights

- Council has recommended implementing e-invoicing for B2C transactions in a phased manner to prevent false invoicing. This would allow customers to verify their invoices before reporting them in the GST return. Until now, e-invoicing was applicable to B2B transactions for a registered person with a turnover of over Rs.5 crore.

- After introducing the Invoice Management System, the Council informed the press about the other enhancements to the current GST return filing mechanism, such as a Reverse Charge Mechanism (RCM) ledger and an Input Tax Credit Reclaim ledger.

- The status reports were duly submitted by the Group of Ministers (GoM) formed on rate rationalisation and real estate, respectively, on the basis of which further discussions regarding the above two subjects will be held in upcoming council meetings.

- No changes in No GST changes apply to online gaming; hence, as decided in the 50th GST Council meeting held in October 2023, 28% of the GST stands applicable to casinos, games, and race courses.

- It was held back then that the status would be reviewed after six months of the implementation. As per the status submitted to the GST Council, the revenue from Online Gaming had increased by 412% in 6 months to Rs. 6,909 crores from Rs.1,349 crores before the notification was issued, whereas the revenue in case of casinos was increased by 30%, i.e., from Rs.164 crores to Rs. 214 crores.

- It was decided to create two new GoMs: GoM on medical and health insurance which is just an extension of the existing GoM formed on rate rationalisation headed by deputy CM of Bihar with newer members – Bihar, UP, West Bengal, Karnataka, Kerala, Rajasthan, Andhra Pradesh, Meghalaya, Goa, Telangana, Tamil Nadu, Punjab, and Gujarat – for limited purpose The newly formed GoM is required to submit the report by the end of October 2024. Hence, the GST Council maintained the status quo by keeping the GST rate at 18% on life and health insurance and deferring it to the next meeting, which will happen in November.

- In June last year, the central government notified an extension of the compensation cess on luxury and demerit goods till March 2026.

- The Union Minister informed that by January 2026, they would repay the back-to-back loans taken and the interest thereon. The total cess collection (actual + projected) up to March 2025 was Rs.8,66,706 crores, whereas the compensation paid till 5th September 2024 was Rs.6,64,203, back-to-back loans repayable was Rs.2,69,208 crores and interest was Rs.51,561 crores and so it was agreed to form GoM for studying the figures and how to move forward with the cess.

- A Committee of Secretaries under the chairmanship of the additional secretary revenue will be set up to explain and decide how to proceed with the IGST. Given a negative balance in IGST, how to retrieve the excess IGST passed on to some states will be studied. They must also submit the report by the end of October 2024.

- Funds given for research to state-affiliated universities or research centres formed under state/central laws or those institutions which have obtained income tax exemptions u/s 35 of the Income Tax Act can receive research funds from public or private sources and are exempted from GST.