Reserve Bank of India (RBI) has moved approximately 100 tonnes (1 lakh kilograms) of gold from the United Kingdom to its vaults in India, Business Today reported, quoting sources. This is the first time since 1991 that India has undertaken such a large-scale transfer of gold reserves. More than half of the RBI’s gold reserves are held overseas in secure custody with the Bank of England and the Bank of International Settlements, while approximately a third is stored domestically.

India Brings 100 Metric Tonnes Of Gold Back From UK

Why In News

- Reserve Bank of India (RBI) has moved approximately 100 tonnes (1 lakh kilograms) of gold from the United Kingdom to its vaults in India, Business Today reported, quoting sources.

- This is the first time since 1991 that India has undertaken such a large-scale transfer of gold reserves. More than half of the RBI’s gold reserves are held overseas in secure custody with the Bank of England and the Bank of International Settlements, while approximately a third is stored domestically.

Current Scenario

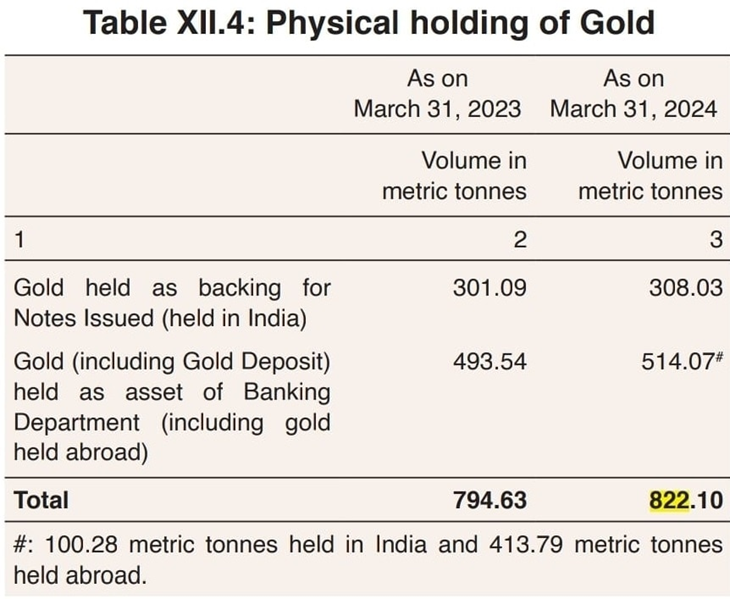

- It may be noted that the move is expected to help the RBI save on storage costs currently paid to the Bank of England. As per the annual report of the central bank for FY24 released on Thursday, over 308 metric tonnes of gold is held in India as backing for notes issued, while another 100.28 tonnes is held locally as an asset of the banking department

- The central bank held 822.10 tonnes of gold as part of its foreign exchange reserves as of March 31, 2024, an increase from the 794.63 tonnes held at the same time last year, according to the annual data released by the RBI.

- Prominent economist Sanjeev Sanyal said, “While no one was watching, RBI has shifted 100 tonnes of its gold reserves back to India from UK.”

- “Most countries keep their gold in the vaults of the Bank of England or some such location (and pay a fee for the privilege). India will now hold most of its gold in its own vaults. We have come a long way since we had to ship out gold overnight in 1991 in the midst of a crisis,” he added.

- “For those of my generation, the shipping out of gold in 1990-91 was moment of failure that we will never forget. This is why this shipping back of gold has a special meaning,”

What Happened In 1991

- In 1991, facing a severe balance of payments crisis, the Chandra Shekhar government pledged gold to raise funds. Between July 4 and 18, the Reserve Bank of India (RBI) pledged 46.91 tonnes of gold with the Bank of England and the Bank of Japan, securing $400 million.

- Around 15 years ago, the RBI purchased 200 tonnes of gold from the International Monetary Fund (IMF) under the United Progressive Alliance (UPA) government led by Prime Minister Manmohan Singh, diversifying its assets with a $6.7 billion investment.

- In recent years, the RBI has consistently built up its gold reserves.

- The central bank’s strategy of holding gold is primarily aimed at diversifying its foreign currency assets, hedging against inflation, and mitigating foreign currency risks.

- Since December 2017, the RBI has regularly acquired gold from the market.

- As a result, the share of gold in India’s total foreign exchange reserves increased from 7.75% at the end of December 2023 to about 8.7% by the end of April 2024.

- Domestically, gold is stored in vaults located in the RBI’s buildings on Mumbai’s Mint Road and in Nagpur.

- According to a World Gold Council report, global central banks hold about 17% of all the gold ever mined, with reserves reaching 36,699 metric tons by the end of 2023.

- It is worth mentioning that the majority of these acquisitions occurred over the last 14 years, as central banks became net buyers of gold starting in 2010.