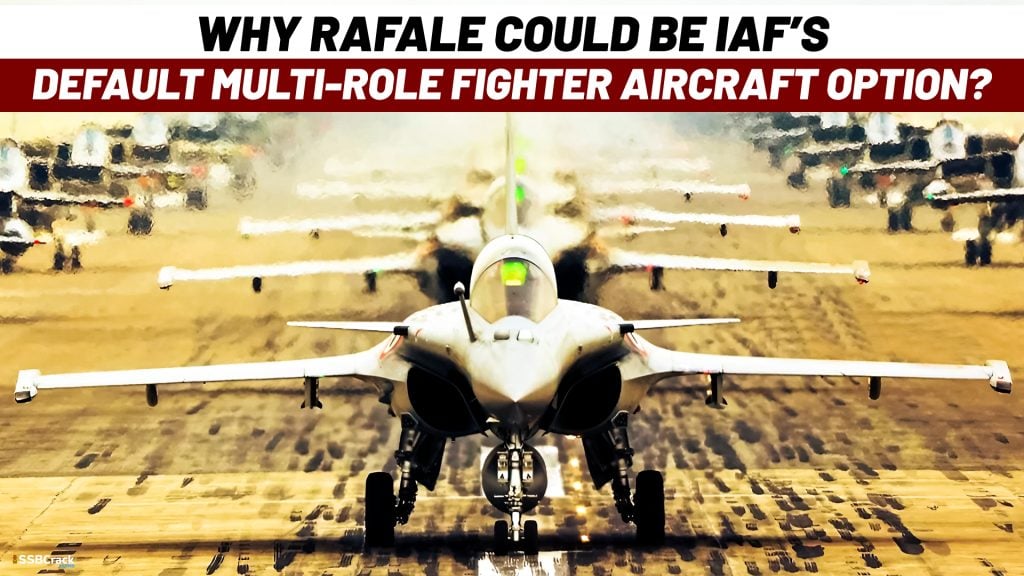

Rafale Could Be IAF’s Default Multi-role Fighter Aircraft Option: A RANGE OF RECENT EVENTS has put Dassault Aviation, France’s leading combat aircraft manufacturer, in pole position to potentially secure the IAF’s long-pending need for 114 multi-role fighter aircraft (MRFA) with its twin-engine Rafales.

Why Rafale Could Be IAF’s Default Multi-Role Fighter?

To connect the connections, a group of military veterans, defence analysts, and industry executives have proposed that, backed by rising Rafale sales to India and Dassault’s willingness to share fighter and related technologies with it, the IAF may end up with Rafale as its default MRFA option.

If that happens, it will be an ironic re-enactment of the Ministry of Defence’s stillborn 2007-08 offer for 126 Rafales, 108 of which were to be licence-built by Hindustan Aeronautics Limited, which was abandoned in 2015 due to contractual, political, and bureaucratic snafus.

A consideration of these new developments concerning the likely introduction of additional Rafales into the IAF is informative on numerous levels. Dassault will first supply the Indian Navy (IN) with 26 Rafale-M (Marine) fighters for deployment on the newly commissioned aircraft carrier INS Vikrant.

The MRCBF’s ‘commonality’ with the 36 Rafales bought by the IAF in 2016 for $9 billion affected the IN’s choice following user trials in 2022, which included the competing Boeing F/A-18 Block III ‘Super Hornet’ fighter.

The delivery of these 26 fighters over the next two to three years will bring India’s Rafale inventory to 62 types, which is not a small amount. According to several retired senior fighter pilots, raising this quantity further to meet the IAF’s request for 114 MRFA makes ‘immense operational, commercial, and logistical sense.’

They claimed that Dassault had already created a Rafale flying training and Maintenance, Repair, and Overhaul (MRO) facility at Ambala Air Force Station, which would help to reduce total costs for any additional purchases. Importantly, acquiring tried-and-tested Rafales will speed up fighter inductions by eliminating trials, as well as augment the IAF’s decreasing fighter squadrons, which have shrunk to about 29 from a sanctioned strength of 42.

They also stated that obtaining additional Rafales will help to streamline the IAF’s broad fighter portfolio, which now includes seven aircraft types, all of which are a logistical headache and a costly affair for the force.

Dominance of Rafale over MRFA?

In a related development that could boost Dassault’s MRFA bid, the French manufacturer is said to be in advanced talks to acquire a 51% position in the Dassault Reliance Aerospace Limited (DRAL) joint venture in Nagpur with its partner Anil Ambani. In particular circumstances, India allows 100 per cent foreign direct investment, and Dassault is allegedly interested in acquiring DRAL, which, if completed, would increase its chances of landing the MRFA contract.

Dassault currently controls 49% of DRAL, which was founded within days of India approving the IAF’s 36 Rafale acquisition to discharge the 50% offset obligation under MoD procurement processes. DRAL was initially charged with making components for Dassault’s Falcon business aircraft, and it had only lately begun providing sub-assemblies such as engine doors and canopies for Rafales. However, according to media reports, a local financial resource shortage has limited DRAL’s manufacturing capacity, making it vulnerable to a purchase.

Meanwhile, the MRFA procurement calls for the importation of a squadron of 18 shortlisted fighters in flyaway condition selected from among seven models provided by overseas original equipment manufacturers (OEMs) in answer to the IAF’s April 2018 Request for Information (RFI).

The other 96 platforms would be manufactured in-house by a joint venture between the qualified OEM and a domestic strategic partner (SP) from either the commercial or public sectors, with progressively higher levels of indigenisation in the overall transaction worth roughly $25 billion.

According to industry insiders, the MRFA tender will be issued soon, with the selected platform needing to fulfil 30-35 years of squadron duty or 6,000 hours of flying time, with at least one midlife upgrade. Senior IAF officials predicted that MRFA numbers may climb to roughly 200 units for the IAF alone, with possible export options, culminating in cost amortisation of the platforms.

Other Alternatives India Had

Eurofighter Typhoon, Sweden’s Saab (Gripen-E), Russia’s United Aircraft Corporation and Sukhoi Corporation (MiG-35 ‘Fulcrum-F’ and Sukhoi Corporation (MiG-35 ‘Flanker-E’), and the United States Boeing and Lockheed Martin (F/A-18 and upgraded F-21) are the six other OEMs that answered to the IAF’s MRFA RFI.

However, given the ongoing conflict in Ukraine, evaluating the two Russian fighter types for eventual IAF acquisition was understandably irrational, especially given the force’s fleet of 260 multi-role Sukhoi-30 MKIs and 50-odd upgraded MiG-29M fighter-bombers.

Alternatively, shortlisting the Typhoon would merely add to the IAF’s ongoing logistical issues, while the US F-18 and F-21 — a modified F-16 — had been rejected on several capability counts during testing for the cancelled MMRCA contract from 2010 onwards. The Gripen-E was a single-engine platform, and while the MRFA RFI did not specify a preference for single or dual power packs, the IAF’s inherent preference for the latter remains unsaid.

As a result of the elimination process, Rafale was more than favourably situated in the MRFA sweepstakes, owing not only to its operational superiority over its opponents, as recognised by the IAF — and now by the IN — but also to a slew of other criteria.

MMRCA vs Rafale

There was also the abandoned contractual template for the MMRCA contract, which, according to industry officials, could be simply ‘tweaked’ to suit a comparable MRFA acquisition by correcting previous errors and shortening negotiations. These irregularities stemmed from the MoD’s request that Dassault bore ultimate quality control responsibility for the 108 Rafales licenced to HAL. This unjustified conditionality proved to be the deal-breaker for the MMRCA sale, resulting in the IAF acquiring only 36 Rafales in flyaway condition, all of which were delivered by late 2022.

Even from a geopolitical standpoint, Indian diplomats and security officials admitted that doing material commerce with Paris was less ‘arduous’ than with Washington because the former was more flexible and pragmatic than the latter, particularly when it came to transferring hi-tech.

To crack the SSB Interview and join the Indian Armed Forces as an Officer, You can join our SSB interview live classes batch and we recommend you to Enroll SSB INTERVIEW ONLINE COURSE. Trusted by thousands of defence aspirants.

- CATS Warrior 2: IAF’s Future Unmanned Fighter-Bomber Aircraft

- Know the Difference Between IAF’s Rafale and Rafale-M of the Indian Navy

- Why did India Choose Rafale-M Over the F/A-18 Super Hornet of the USA?

- All Fighter Aircraft Of India – How To Identify Them

- All Fighter Jet Acquisitions By The IAF

- Twin Engine Deck-Based Fighters (TEDBF)

- Should India Buy Su-75 ‘Checkmate’ And What Is The Alternative?

- All About India’s 5th Generation Fighter Jet ‘AMCA’

- All You Need To Know About Indian Navy MRCBF (Multi-Role Carrier-Borne Fighter)

- What Is DRDO Ghatak (Swift) Drone?

- Everything You Need To Know About LCA Tejas

- All About India’s 5th Generation Fighter Jet ‘AMCA’