The Reserve Bank of India (RBI) has developed a lightweight and portable payment system to ensure that payment networks continue to function during emergencies such as natural catastrophes or conflicts. This technology is specifically developed to facilitate critical transactions and maintain the economy’s liquidity flow. According to the central bank, the envisioned Light Weight and Portable Payment System (LPSS) will operate autonomously, separate from traditional technology, and may be handled remotely with minimum employees.

Why In The News?

- In Its Annual Report For 2022-23 Published On May 30, 2023, RBI Said That The Lightweight And Portable Payment System Is Expected To Operate On Minimalistic Hardware And Software And Would Be Made Active Only On A “Need Basis”.

Heavy Surge In Digital Payments:

- During 2022-23, The Payment And Settlement Systems Recorded A Robust Growth Of 57.8 Percent In Terms Of Transaction Volume On Top Of The Expansion Of 63.8 Percent Recorded In The Previous Year.

- The Share Of Digital Transactions In The Total Volume Of Non-cash Retail Payments Increased To 99.6 Percent During 2022-23, Up From 99.3 Percent In The Previous Year.

UPI Payments Transfer:

- UPI Is A Free, Instant, And Real-time Payment System That Is Generally Used To Perform Quick Payments To Merchants And Banks.

- You Can Do Online UPI Payments Using UPI Apps As Well As Offline UPI Payments Using UPI Lite.

- UPI Was First Launched In 2016 By The National Payments Corporation Of India (NPCI) And Is Also Known As A Better Version Of The IMPS Payments Facility.

- While The UPI Payments Service Is Free Of Any Charges For Us Consumers, Banks Do Bear Hundreds Of Crores Of Cost Each Year.

RTGS Transfer:

- Real-time Gross Settlement Is A Funds Transfer Process Generally Used To Transfer Higher Amounts.

- It Is A Safe And Secure Way Of Transferring Money As The Settlement Takes Place In Real Time.

- An RTGS Transaction Is Free Of Charge When Done Online And Is Initiated, Cleared, And Settled In Real-time, Usually Within 30 Minutes, Making It One Of The Best, Free, And Fastest Ways To Transfer High Amounts Of Funds Instantly.

- It Does Not Have Any Upper Limits On The Maximum Amount That The Remitter Can Send.

- Earlier RTGS Transactions Could Not Be Processed 24/7 Or On Public Holidays But Thanks To The Statement Released In 2020 By RBI, RTGS Transactions Can Now Be Done Anytime And Any Day

IMPS Transfer:

- IMPS (Immediate Payments Service) Was First Launched By NPCI In 2010 And Is One Of The Most-used Fund Transfer Methods In India.

- For Doing An IMPS Funds Transfer, You Do Not Need The Beneficiary’s Bank Account Details As A Simple 7-digit MMID Code Is Used To Do An IMPS Transfer.

- This 7-digit MMID Code Is Allotted By The Bank. After UPI, An IMPS Transaction Would Probably Be The Fastest Way To Transfer Funds Up To 5 Lakhs.

- An IMPS Funds Transfer Is Better Suited If You Are Looking To Transfer Amounts Up To 5 Lakhs Instantly Or In An Emergency. After UPI, IMPS Is Probably The 2nd Most Economical Way To Transfer Funds.

NEFT Transfer:

- NEFT Transfers Or National Electronic Funds Transfers Is An RBI-governed Funds Transfer Method, Available Online And Offline.

- NEFT Payments Were First Introduced In 2005 And They Are Extremely Safe And Secure Methods Of Transferring Small Amounts Of Money.

- Even Though NEFT Transfers Do Not Have An Upper Limit, They Are Generally Limited To ₹50K Per Transaction Limit For New Beneficiaries.

- NEFT Unlike IMPS Does Not Have Fees Or Charges On Online Transfers.

- However, One Of The Biggest Disadvantages Of NEFT Transfer Is That The Money Does Not Get Credited To The Beneficiary Instantly As An NEFT Transaction Takes Place In Batches.

- Hence, You Should Probably Avoid Doing NEFT Transfers If You Need To Transfer High-value Funds Instantly.

‘Lightweight’ Payments System For Emergencies:

- The RBI Has Conceptualized A Lightweight Payment And Settlements System, Which It Is Calling A “Bunker” Equivalent Of Digital Payments, Which Can Be Operated From Anywhere By A Bare Minimum Staff In Exigencies Such As Natural Calamities Or War.

- The Infrastructure For This System Will Be Independent Of The Technologies That Underlie The Existing Systems Of Payments Such As UPI, NEFT, & RTGS. The Central Bank Has Not Offered A Timeline For The Launch Of This Payment System Yet.

Why Is There A Need For Such Payments System?

- Such A Lightweight And Portable Payment System Could Ensure Near Zero Downtime Of The Payment And Settlement System In The Country And Keep The Liquidity Pipeline Of The Economy Alive And Intact By Facilitating Uninterrupted Functioning Of Essential Payment Services Like Bulk Payments, Interbank Payments, And Provision Of Cash To Participant Institutions.

- The System Is Expected To Process Transactions That Are Critical To Ensure The Stability Of The Economy, Including Government And Market Related Transactions. Having Such A Resilient System Is Also Likely To Act As A Bunker Equivalent In Payment Systems And Thereby Enhance Public Confidence In Digital Payments And Financial Market Infrastructure Even During Extreme Conditions.

How The Lightweight System Be Different From UPI?

- There Are Multiple Payment Systems Available In The Country For Use By Individuals As Well As Institutions, Each Of Which Has Its Distinct Character And Application.

- Existing Conventional Payment Systems Such As RTGS, NEFT, And UPI Are Designed To Handle Large Volumes Of Transactions While Ensuring Sustained Availability.

- As A Result, They Are Dependent On Complex Wired Networks Backed By Advanced IT Infrastructure.

- However, Catastrophic Events Like Natural Calamities And War Have The Potential To Render These Payment Systems Temporarily Unavailable By Disrupting The Underlying Information And Communication Infrastructure.

- Therefore, It Is Prudent To Be Prepared To Face Such Extreme And Volatile Situations.

To crack the SSB Interview and join the Indian Army as an Officer, You can join our SSB interview live classes batch and we recommend you to Enroll SSB INTERVIEW ONLINE COURSE. Trusted by thousands of defence aspirants.

Also read:

- 20th ASEAN-India Summit & 18th East Asia Summit Highlights

- Manipur Police Register Criminal Case Against Assam Rifles

- Pakistan’s Ex-PM Imran Khan Jailed For 3 Years In ‘Toshakhana Case’

- Four Years After Removal Of Art 370: How Is The Actual Situation In Kashmir?

- Putin’s Critic Alexei Navalny Sentenced To 19 More Years In Prison

- Delhi Services Bill Tabled In Lok Sabha: Govt Of NCT Of Delhi (Amendment) Act, 2023

- Gurugram Nuh Violence: How A Religious Procession Turned Into A Communal Clash

- Govt Imposes Import Restrictions On Laptops, Tablets, Computers

- How Climate Change Is Altering The Colour Of The Oceans?

- New IPCC Assessment Cycle Begins: Why Is It So Significant?

- Difference Between NATO Vs Russia? [Explained]

- Italy Regrets Joining China Belt & Road Initiative (BRI)

- What Is Doping: Why Is It Banned In Sports?

- India Tiger Census 2023: India Is Now Home To 75% Of Tigers In The World

- Military Coup In Niger – President Detained, All Institutions Suspended

- No-Confidence Motion Against PM Modi’s Government

- Elon Musk’s SpaceX Rocket Punches Hole In Ionosphere

- Israeli Parliament Passes Controversial Law Stripping Supreme Court Of Power

- Significance Of 1999 Kargil War: How It Became A Major Game Changer For Indian Military?

- Controversy Over Movie Oppenheimer Gita Scene: How Are Films Certified In India?

- The Curious Case Of Qin Gang: China’s Foreign Minister Who Went Missing

- Twitter’s Iconic Blue Bird Logo Set To Be Replaced By An X Logo

- India Pulls Out Of Games In China Over Stapled Visas For Arunachal Athletes

- PM Modi Urges Sri Lanka President To Implement 13th Amendment

- India Pulls Out Of Games In China Over Stapled Visas For Arunachal Athletes

- Rajasthan CM Sacks Minister After Remarks Over Crimes Against Rajasthan Women

- Manipur Sexual Assault: Video Sparks Outrage Across The Country

- BRICS Summit 2023 In August: Why Putin Won’t Go To South Africa For The Summit?

- Robert Oppenheimer: The Father Of Atomic Bomb, Impact Of Bhagavad Gita On Him

- Russia-Ukraine Black Sea Grain Deal, Why Russia Has Halted It?

- Henley Passport Index 2023, India Passport Ranked 80th

- Indian Opposition Parties Form ‘INDIA’ Alliance, 26 Parties Unite For 2024

- Britain Joins Asia-Pacific Trade Group ‘CPTPP’ – Biggest Trade Deal Since UK Left EU

- NITI Aayog Report On National Multidimensional Poverty Index

- PM Modi UAE Visit: Highlights & Key Takeaways

- PM Modi’s Visit To France: Highlights & Key Takeaways

- NATO Summit Vilnius 2023: Highlights & Key Takeaways

- Turkey Supports Sweden’s Bid For NATO Membership At Vilnius Summit 2023

- Why ISRO Wants To Explore The Moon’s South Pole: Chandrayaan-3 Mission

- Bengal’s Panchayat Polls Turned Violent: SSB Interview Topic 2023

- First Ever IIT Campus Outside India In Tanzania

- RBI’s Report On “Internationalisation Of Rupee” Why And What Are The Benefits?

- Japan To Release Nuclear Wastewater Into Ocean – Gets Approval From IAEA

- PM Modi Chairs 23rd SCO Summit: Highlights & Key Takeaways

- Israel Raids Jenin Camp: Massive Military Operation In West Bank

- Dutch King Apologizes For Netherlands’ Role In Slavery: A Look At The Dutch Role In History

- Constitutional Crisis In Tamil Nadu: The Tussle Between Governor & DMK Government

- Why Has France Been Engulfed By Protests Again?

- Paris Summit – World Leaders Unite For A New Global Financing Pact

- India Ranked 67th On Energy Transition Index – Sweden On Top Of List By World Economic Forum

- Four Minor Planets Named After Indian Scientists

- NASA Recovers 98% Water From Urine & Sweat On ISS: Breakthrough In Long Space Missions

- ESA Space Telescope Euclid Is All Set For Launch To Observe Dark Side Of Universe

- PM Modi’s Trip To USA: Key Takeaways & Highlights

- PM Modi-Led Yoga Session Creates A New Guinness World Record

- Sajid Mir, The Mastermind Behind 26/11 – His Designation As Global Terrorist Blocked By China

- UN Adopts First Historic ‘High Seas Treaty’ To Protect Marine Life

- International Yoga Day 2023 – How It Was Celebrated Across The World?

- Gender Apartheid – Why Is Afghanistan At Stand Off With UN?

- Gandhi Peace Prize 2021 For Gita Press Why It Triggered A Congress-BJP Brawl?

- The New Pride Flag – Why The Change & What The Colours Signify?

- 48 Years Of Emergency – PM Modi Refers It As India’s Darkest Period In Mann Ki Baat

- Groundwater Extraction Has Tilted Earth’s Spin – How Will It Impact The Climate Change?

- Europe’s Worst Migrant Boat Disaster – 78 Dead, Hundreds Missing Off Greek Coast

- MOVEit Global Hacking Attack – Government Agencies In The USA Targeted

- Karnataka Govt Decides To Repeal Anti-Conversion Law: Why Was The Law Controversial?

- IIT Bombay Among Top 150 Varsities In QS Rankings 2024

- China’s Xi Jinping Backs ‘Just Cause’ Of Palestinian Statehood – Chinese Middle Eastern Diplomacy

- Turkey Won’t Back Sweden’s Bid To Join NATO – Why Is Erdogan Against Sweden’s Application

- UN Report Reveals Chronic Bias Against Women – 25% Of Population Thinks Beating Wife Justifiable

- Zinnai – Space Flower Grown On International Space Station By NASA – Why Is It Significant?

- Who Are Meira Paibis: Manipur’s ‘Torch-Bearing’ Women Activists?

- USA Set To Re-Join UN Cultural Agency UNESCO

- CoWIN Data Leak – Aadhaar, PAN Card Info, On Covid Portal, Made Public By Telegram

- $10bn Investment Deals Signed At Arab-China Summit – Is Arab World Moving Towards China?

- Cyclone Biparjoy Turns Into Extremely Severe Cyclonic Storm – 10 Points To Know

- PM Modi’s Trip To Egypt: Highlights & Key Takeaways

- El Nino Returns After 7 Years: Will Impact Second Half Of Monsoon

- Europe’s Copernicus Programme Completes 25 Years: SSB Interview Topic

- Trump Charged Over Secret Documents In A First For An Ex-US President

- 39 Years Since Operation Bluestar: What Actually Happened?

- Wagner Chief Vows To Topple Russian Military Leaders

- Arctic Could Be Ice-Free In The Summer By 2030: SSB Interview Topic

- PM Modi’s School In Gujarat Will Host Students From Across India

- Major Dam Collapse In Ukraine – Accuses Russia Of Blowing Up Kakhovka Dam

- Microsoft To Pay $20 Million For Illegally Collecting Children’s Info

- NIRF Ranking 2023: IIT Madras Tops The List For 5th Consecutive Year

- TRAI’s ‘Digital Consent Acquisition’ (DCA) Facility’- Unified Platform For Customers’ Consent

- 34th Anniversary Of Tiananmen Square Protest – Hong Kong Police Detains Activists

- Asia Security Summit 2023 Shangri-La Dialogue Begins Amid China-US Tensions

- Coromandel Express Accident – How 3 Trains Derailed, Crashed At Same Place In Odisha

- Law Commission Against Scrapping Of Sedition Law, Says It Will Protect India’s Unity

- Radical Changes In NCERT Textbooks – Poverty, Inequality, Democracy Among Topics Removed

- India GDP Data Beats Expectations – Stays Fastest Growing Economy

- Maharashtra’s Ahmednagar To Be Renamed Ahilyanagar

- Scientists Discover 2nd Moon Near Earth Orbiting Since 100 BC

- Erdogan’s Victory In Turkish Election – What Can Be The Impact On India?

- NASA Alert! GIANT Asteroid Racing Towards Earth

- Uganda Signs Anti-Gay Law With Death Penalty – Sparks Global Outrage

- RBI’s ‘Lightweight’ Payments System For Emergencies – An Alternative To UPI, NEFT, RTGS

- Significance Of ISRO’s Newly Launched NavIC Satellite In Regional Navigation

- What Is The Model Prisons Act – Reforms In The Indian Prisons System?

- Global Plastic Treaty – Negotiations Underway For A Plastic-Free Planet: SSB Interview Topic

- China Sends First Civilian Astronaut To Space As Shenzhou-16 Blasts Off

- US Congressional Panel Suggests Making India Part Of NATO Plus: SSB Interview Topic

- India Conducts National Cyber Defence Exercise

- What Is XPoSat, India’s First Polarimetry Mission?

- Germany Falls Into Recession As Inflation Hits Economy

- Bangladesh Faces Fuel Crisis – Dollar Shortage Issue

- Australian Universities Ban Student Applications From Certain Indian States

- What Is Volt Typhoon: China-Backed Hackers Targeting USA?

- Death Of Six Cheetahs At Kuno National Park: SSB Interview Topic 2023

- India-Australia Relations Get Stronger – What Is Migration Deal?

- What Is Sengol: To Be Placed In The New Parliament Building?

- Annual Misery Index – India Ranks 103 Out Of 157 Nations: SSB Interview Topic

- Russia Pressures India For Help To Avoid Getting Blacklisted By FATF

- What Is Mission LiFE – How It Will Fight Against Climate Change?

- What Is The ‘Pandemic Treaty’: How WHO Could Fight Future Pandemics?

- Assam CM Himanta Biswa Sarma Announces Withdrawal Of AFSPA

- El Nino Could Hit World Economy By $3 Trillion? SSB Interview Topic 2023

- Tussle Between Delhi Govt And Centre – Delhi Ordinance Issue: SSB Interview Topic

- China Braces For New Covid Wave With Up To 65 Million Weekly Cases

- Colour-Coded Warnings By The IMD: SSB Interview Topic 2023

- Saudi Scripts History As First Arab Woman Astronaut Lifts Off Into Space

- Controversy Behind Inauguration Of Parliament Building: SSB Interview GD Topic

- Uniform Civil Code: Is Time Ripe For the Indian Government To Act On It?

- Indian-Origin Ajay Banga To Be The Next World Bank President

- AI ‘Godfather’ Geoffrey Hinton Quits Google Warns Of Danger Ahead

- India Ranks 161 Out Of 180 Countries – World Press Freedom Index

- Supreme Court Rules It Can Directly Grant Divorce To Couples: SSB Interview GD Topic

- Kashmir All Set To Hold G20 Summit In India

- Go First Airlines Files For Insolvency: SSB GD Topic

- India Becomes Europe’s Largest Supplier Of Refined Fuels

- What Is The Met Gala – Fashion’s Biggest Night?

- Clashes In France Against Pension Reforms By Macron Govt

- Why Are Indian Wrestlers Protesting Against WFI Chief?

- China Offers Ukraine To Mediate To End War With Russia

- 50 Years Of Kesavananda Bharati Case: SSB Interview Lecturette Topic

- Assam-Arunachal Pradesh Border Dispute: SSB Interview Lecturette Topic 2023

- Same-Sex Marriages In India: Key Supreme Court Verdicts On LGBTQ Rights

- What Is China Plus One? SSB Interview Lecturette Topic 2023

- India-Maldives Relations: SSB Interview Lecturette Topic 2023

- India-Bangladesh Relations: SSB Interview Lecturette Topic 2023

- India-Japan Relation: SSB Interview Lecturette Topic 2023

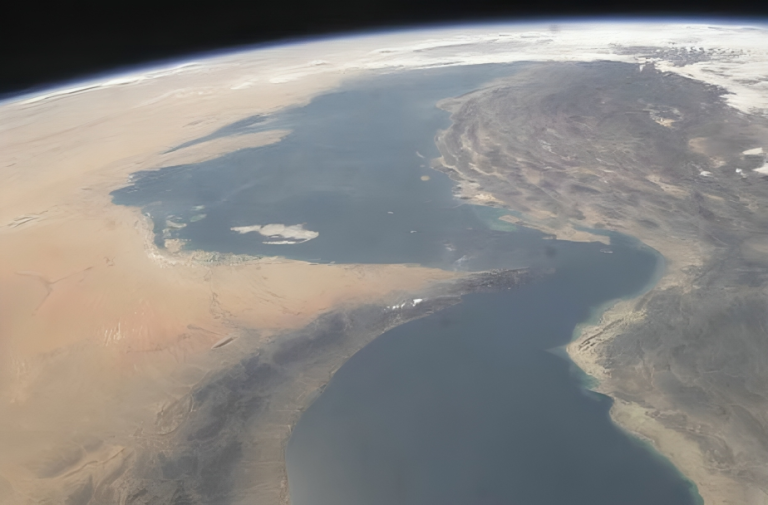

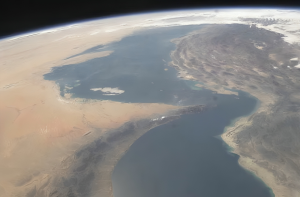

- Geopolitical Importance Of The Indian Ocean: SSB Interview Lecturette Topic 2023

- All About Paris Club: SSB Interview Lecturette Topic

- PM Narendra Modi Has Been Named The Most Popular Leader In The World

- Hindenburg Report On Adani – Here’s What You Need To Know

- India At WEF Davos Summit 2023: Here Are 10 Key Highlights

- Pakistan Economic Crisis 2023: SSB Interview Topic [Fully Explained]

- Joshimath Crisis: What Does “Land Subsidence” Mean, And Why Does It Happen?

- Top 10 Animal Conservation Projects In India [MUST WATCH]

- What Is Shanghai Cooperation Organisation (SCO) Summit 2022? [Fully Explained]

- 20 SSB Interview Questions On Russia Ukraine Crisis

- What Is The (India-Israel-UAE-USA) I2U2 Summit? [Fully Explained]

- What Is International North-South Transport Corridor (INSTC)?

- What Is Sri Lankan Crisis? [Fully Explained]

- What Is The BIMSTEC Grouping And How Is It Significant? [EXPLAINED]

- What Is The Places Of Worship (Special Provisions) Act, 1991? [Explained]

- What Is Bodo Accord | SSB Interview Notes [Fully Explained]

- What Is AFSPA: Armed Forces (Special Powers) Act?

- What Is G20 Or Group Of Twenty Countries?

- What Is AFSPA: Armed Forces (Special Powers) Act?

- What Is The Financial Action Task Force (FATF)? [Fully Explained]

- What Is Quadrilateral Security Dialogue (QUAD)?

- Difference Between NATO Vs Russia [Expained]

- What Is United Nations Security Council (UNSC) [Explained]

- Everything You Need To Know About SAARC: South Asian Association For Regional Cooperation

- All About Russia Ukraine War: SSB Interview Topic [Fully Explained]